Get ready to dive into the world of Asset allocation strategies. This ain’t your average investing talk – we’re about to drop some knowledge bombs that’ll have you seeing your portfolio in a whole new light.

From traditional methods to modern theories, we’ve got the lowdown on how to make your money work smarter, not harder.

Introduction to Asset Allocation Strategies

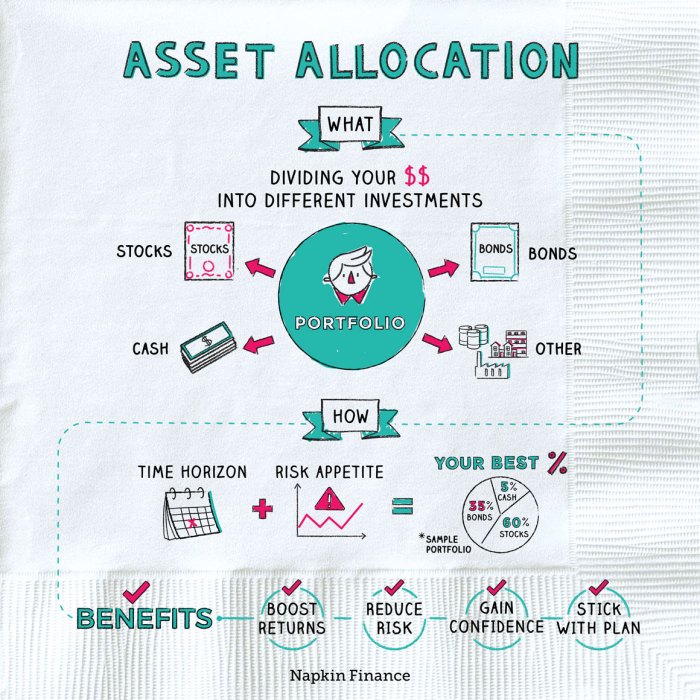

Asset allocation refers to the process of dividing an investment portfolio among different asset classes such as stocks, bonds, and cash equivalents. This strategy aims to balance risk and reward based on an individual’s financial goals, risk tolerance, and time horizon.

The importance of asset allocation in investment portfolios cannot be overstated. By diversifying across different asset classes, investors can reduce the overall risk of their portfolio and potentially increase returns over the long term. Asset allocation helps investors navigate market fluctuations and achieve a more stable investment performance.

Examples of Different Asset Classes

- Stocks: Also known as equities, stocks represent ownership in a company and offer the potential for high returns but also come with higher volatility.

- Bonds: Bonds are debt securities issued by governments or corporations, providing a fixed income stream with lower risk compared to stocks.

- Cash Equivalents: These include assets like money market funds and Treasury bills, offering liquidity and stability with lower returns.

Traditional Asset Allocation Strategies

Strategic asset allocation plays a crucial role in determining the overall investment strategy of an individual or institution. It involves setting target allocations for various asset classes such as stocks, bonds, and cash equivalents based on long-term objectives and risk tolerance.

Role of Risk Tolerance

Risk tolerance refers to an individual’s or entity’s ability and willingness to withstand fluctuations in the value of their investments. It is a key factor in determining asset allocation as it helps in balancing the desired level of risk and potential return. For instance, an investor with a higher risk tolerance may allocate a larger portion of their portfolio to stocks, which are considered more volatile but offer higher potential returns.

Traditional Asset Allocation Models

- The 60/40 Portfolio: One of the most well-known traditional asset allocation models is the 60/40 portfolio. This strategy involves allocating 60% of the portfolio to equities (stocks) and 40% to fixed-income securities (bonds). The goal is to strike a balance between growth and stability, with the equity portion providing potential long-term growth and the fixed-income portion offering income and stability.

Modern Portfolio Theory

Modern Portfolio Theory (MPT) is a framework for constructing investment portfolios that aim to maximize expected return for a given level of risk. Developed by Harry Markowitz in the 1950s, MPT emphasizes the importance of diversification and the relationship between risk and return in investment decisions.

Principles of Modern Portfolio Theory

- Asset Allocation: MPT suggests that investors should spread their investments across different asset classes to reduce risk.

- Efficient Frontier: MPT identifies the optimal portfolio that offers the highest return for a given level of risk or the lowest risk for a given level of return.

- Risk-Return Tradeoff: MPT highlights the tradeoff between risk and return, indicating that higher returns are associated with higher levels of risk.

Benefits of Diversification in Asset Allocation

Diversification is a key principle in MPT that involves spreading investments across various assets to reduce overall risk. By investing in assets with low correlation, investors can minimize the impact of negative events on their portfolio. This helps to achieve a more stable and consistent return over time.

Influence of MPT on Asset Allocation Decisions

MPT has revolutionized the way investors approach asset allocation decisions. By focusing on the relationship between risk and return, MPT encourages investors to build portfolios that are diversified and aligned with their risk tolerance and investment goals. This approach helps investors achieve a balance between maximizing returns and managing risk effectively.

Tactical Asset Allocation Strategies

Tactical asset allocation involves actively adjusting the asset mix in a portfolio in response to short-term market conditions or specific opportunities. Unlike strategic asset allocation, which is more focused on long-term goals and involves setting target allocations based on risk tolerance and investment objectives, tactical asset allocation seeks to capitalize on market inefficiencies or trends in the short term.

Comparison with Strategic Asset Allocation

Strategic asset allocation is a more passive approach that involves setting a long-term target asset allocation and periodically rebalancing the portfolio to maintain those targets. In contrast, tactical asset allocation is more dynamic and opportunistic, allowing investors to take advantage of short-term market movements or undervalued assets.

- Tactical asset allocation is based on short-term market conditions, while strategic asset allocation is focused on long-term goals.

- Tactical asset allocation involves more frequent adjustments to the portfolio, while strategic asset allocation is more static.

- Tactical asset allocation may involve deviating significantly from the strategic asset allocation targets, depending on market opportunities.

Examples of Tactical Asset Allocation Techniques

Some common tactical asset allocation techniques include market timing, sector rotation, and momentum investing.

Market timing involves adjusting the allocation to different asset classes based on short-term forecasts of market movements.

- Sector rotation involves shifting investments between different sectors of the economy based on expected performance.

- Momentum investing involves buying assets that have performed well recently and selling those that have performed poorly, with the expectation that the trend will continue.

Factors Influencing Asset Allocation

Investors consider various factors when determining their asset allocation strategies. These factors play a crucial role in shaping their investment decisions and overall portfolio management.

Investment Goals Impact

- Investment goals are the primary drivers behind asset allocation decisions.

- Short-term goals may require a more conservative approach, focusing on capital preservation.

- Long-term goals, such as retirement planning, may allow for a more aggressive allocation to growth assets.

Investment Horizon Role

- The investment horizon, or the time frame in which an investor expects to achieve their goals, influences asset allocation strategies.

- Longer investment horizons typically allow for a higher allocation to equities and other growth assets due to the ability to ride out market fluctuations.

- Shorter investment horizons may require a more defensive approach to protect capital in case of market downturns.

Economic Conditions Influence

- Economic conditions, such as interest rates, inflation, and economic growth, play a significant role in asset allocation choices.

- In times of economic expansion, investors may tilt towards riskier assets seeking higher returns.

- In contrast, during economic downturns, investors may shift towards safer assets like bonds or cash to protect their portfolios.