Retirement account contributions pave the way to financial freedom, offering a roadmap to a secure future filled with opportunities. Get ready to dive into the world of retirement savings, where every dollar counts towards a brighter tomorrow.

Introduction to Retirement Account Contributions

Retirement account contributions refer to the money individuals set aside regularly to save for their retirement years. These contributions are crucial for building a nest egg that will support them financially once they stop working.

Contributing to retirement accounts is essential to ensure a secure financial future during retirement. By consistently saving and investing in these accounts, individuals can grow their wealth over time and enjoy a comfortable retirement lifestyle.

Types of Retirement Accounts

- 401(k) Plans: Employer-sponsored retirement plans that allow employees to contribute a portion of their salary on a pre-tax basis, with potential employer matching contributions.

- Individual Retirement Accounts (IRAs): Personal retirement accounts that offer tax advantages for savings, including Traditional IRAs and Roth IRAs.

- 403(b) Plans: Retirement accounts for employees of non-profit organizations, public schools, and some government agencies, similar to 401(k) plans.

- Pension Plans: Defined benefit plans provided by employers, guaranteeing a specific monthly benefit upon retirement based on salary and years of service.

Benefits of Retirement Account Contributions

Contributing to retirement accounts comes with various benefits that can help secure your financial future. Let’s explore some of the advantages:

Tax Advantages

- Contributions to retirement accounts such as 401(k) or IRA are often tax-deductible, reducing your taxable income for the year.

- Investment earnings within these accounts grow tax-deferred, allowing your money to compound over time without being taxed annually.

- Qualified withdrawals during retirement are taxed at potentially lower rates, as you may be in a lower tax bracket compared to your working years.

Building a Nest Egg

- Regular contributions to retirement accounts help you build a substantial nest egg over time, providing financial security during your retirement years.

- Compound interest and potential investment growth can significantly increase the value of your retirement savings, allowing you to enjoy a comfortable lifestyle in retirement.

Employer Matching Contributions

- Many employers offer matching contributions to their employees’ retirement accounts, effectively providing free money for your future.

- By taking advantage of employer matches, you can accelerate the growth of your retirement savings and maximize the benefits of your contributions.

Strategies for Maximizing Retirement Account Contributions

Saving for retirement is essential, and maximizing your contributions to retirement accounts is a smart way to secure your financial future. Here are some strategies to help you increase your retirement savings over time.

Catch-Up Contributions

For individuals nearing retirement age, catch-up contributions are a valuable option to boost their retirement savings. Those aged 50 and above are allowed to make additional contributions to their retirement accounts, beyond the standard limits. This allows older individuals to make up for lost time and accelerate their retirement savings.

Impact of Early vs. Late Contributions

Making early contributions to your retirement accounts can have a significant impact on your overall savings. By starting to save for retirement early, you give your investments more time to grow and compound, leading to a larger nest egg in the long run. On the other hand, late contributions may require higher contribution amounts to catch up, but it’s never too late to start saving for retirement. Every dollar saved today can make a difference in your financial security during retirement.

Factors to Consider When Making Retirement Account Contributions

When planning for retirement and making contributions to your retirement account, there are several key factors to keep in mind to ensure you are optimizing your savings and investment strategy.

Impact of Contribution Limits on Different Types of Retirement Accounts

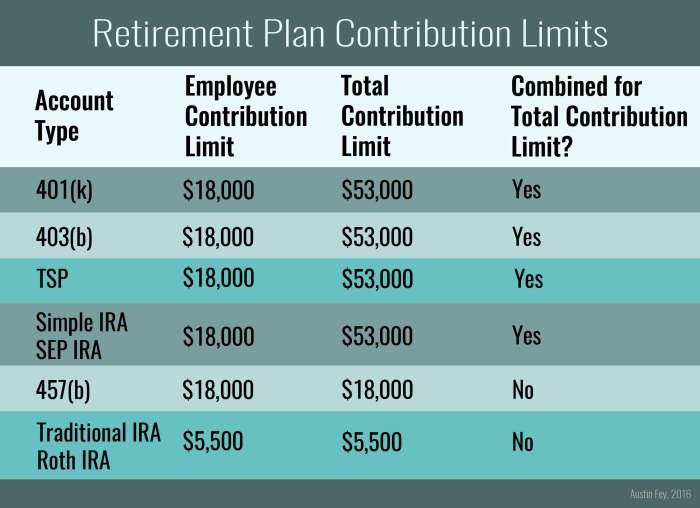

Contribution limits can vary depending on the type of retirement account you have, such as a 401(k), IRA, or Roth IRA. It’s important to be aware of these limits as they can affect how much you can save each year towards your retirement goals.

- 401(k) accounts typically have higher contribution limits compared to IRAs, allowing you to save more money on a tax-deferred basis.

- IRAs have annual contribution limits that are lower than 401(k)s, but they offer more flexibility in terms of investment options and eligibility requirements.

- Roth IRAs have income limits that determine your eligibility to contribute, but they offer tax-free withdrawals in retirement.

Role of Investment Options in Maximizing Retirement Account Contributions

Choosing the right investment options within your retirement account can have a significant impact on the growth of your savings over time.

- Diversifying your investments across different asset classes can help manage risk and potentially increase returns.

- Consider your risk tolerance and investment timeline when selecting investment options to ensure they align with your retirement goals.

- Regularly review and adjust your investment portfolio to adapt to changing market conditions and your evolving financial situation.

Considerations for Balancing Retirement Account Contributions with Other Financial Goals

While saving for retirement is important, it’s also essential to balance your contributions with other financial priorities and goals.

- Take into account other financial obligations such as paying off debt, building an emergency fund, and saving for major expenses like a home or education.

- Striking a balance between saving for retirement and meeting current financial needs can help you avoid sacrificing your long-term financial security for short-term expenses.

- Work with a financial advisor to create a comprehensive financial plan that takes into consideration all aspects of your financial situation and goals.