Yo, diving into Strategies for paying off debt, this intro sets the stage for a real talk on managing that cash flow and getting rid of debt like a boss. From understanding debt to cutting expenses, we got you covered with all the tips and tricks to make that money moves.

So get ready to level up your financial game and say goodbye to debt once and for all. Let’s roll!

Understanding Debt

Debt is money that is borrowed and needs to be repaid, usually with interest. There are different types of debt, including credit card debt, student loans, mortgages, and car loans.

Good Debt vs. Bad Debt

Good debt is typically considered an investment that can increase in value over time, such as student loans for education or a mortgage for a home. Bad debt, on the other hand, is debt incurred for items that decrease in value or do not generate income, such as credit card debt for unnecessary purchases.

Consequences of Carrying High Levels of Debt

- High levels of debt can lead to financial stress and anxiety, affecting mental health.

- Carrying a lot of debt can result in paying significant amounts of interest over time, making it harder to pay off the principal amount.

- Having high levels of debt can negatively impact credit scores, making it difficult to secure loans or favorable interest rates in the future.

Creating a Budget

Creating a budget is essential when it comes to managing debt effectively. It helps you track your expenses, prioritize payments, and stay on top of your financial situation.

Importance of Tracking Expenses

- Tracking expenses allows you to see where your money is going each month.

- It helps you identify areas where you can cut back to allocate more funds towards debt repayment.

- By monitoring your spending, you can avoid unnecessary purchases that can derail your debt payoff plan.

Tips for Creating a Budget

- Start by listing all your sources of income to determine how much money you have coming in each month.

- Next, make a list of all your expenses, including bills, groceries, transportation, and any other necessities.

- Differentiate between fixed expenses (like rent) and variable expenses (like dining out) to better understand your spending habits.

- Set realistic goals for debt repayment and allocate a specific amount of money towards it in your budget.

Budgeting Tools and Methods

- Consider using online budgeting apps like Mint or YNAB to track your spending and set financial goals.

- Envelope budgeting is another effective method where you allocate cash into different envelopes for various spending categories.

- Utilize spreadsheets or budgeting templates to create a visual representation of your budget and track your progress over time.

- Consider starting a side hustle or taking on a part-time job to supplement your primary income. This additional source of revenue can significantly boost your monthly earnings, allowing you to allocate more towards debt repayment.

- Popular side hustles include freelance work, selling handmade goods online, driving for rideshare services, or tutoring students in a subject you excel in. These flexible opportunities can be tailored to fit your schedule and financial goals.

- Part-time jobs in retail, hospitality, or customer service can also provide a steady income stream to help you pay off debts quicker. Look for positions that offer evening or weekend shifts to accommodate your existing work schedule.

- Advocate for yourself at work by scheduling a meeting with your supervisor to discuss the possibility of a raise or promotion. Highlight your accomplishments, skills, and contributions to the company to demonstrate your value as an employee.

- Research industry standards and salary ranges to support your request for a higher salary. Prepare a compelling case outlining why you deserve a raise based on your performance and the market value of your role.

- Be open to feedback and constructive criticism during the negotiation process. Approach the conversation with professionalism and confidence, emphasizing your commitment to the company’s success and your financial goals.

- Limit eating out at restaurants and opt for home-cooked meals to save money.

- Cancel unused subscriptions or memberships to reduce monthly expenses.

- Avoid unnecessary shopping sprees and only purchase items that are truly needed.

- Lower utility bills by conserving energy and water usage in the household.

- Shop around for better insurance rates or bundle policies for discounts.

- Downsize to a smaller living space or find roommates to split housing costs.

Debt Repayment Strategies

When it comes to paying off debt, having a clear strategy in place can make a significant difference in how quickly you can become debt-free. Let’s explore some popular debt repayment strategies that can help you take control of your finances.

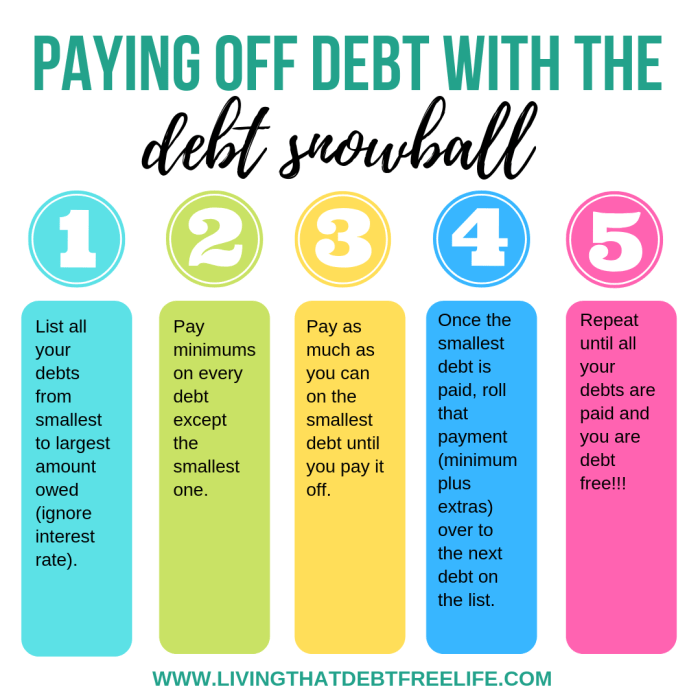

The Snowball Method

The snowball method is a debt repayment strategy where you focus on paying off your smallest debts first while making minimum payments on all other debts. Once the smallest debt is paid off, you then roll that payment into the next smallest debt, creating a snowball effect that helps you tackle larger debts over time. This method is effective for building momentum and motivation as you see debts being eliminated one by one.

The Avalanche Method

In contrast to the snowball method, the avalanche method prioritizes paying off debts with the highest interest rates first. By tackling high-interest debts first, you can save money on interest payments in the long run and pay off your debts more efficiently. While it may not provide the same immediate gratification as the snowball method, the avalanche method can result in significant savings over time.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can make managing debt more straightforward by simplifying payments and potentially reducing the overall interest you pay. However, it’s essential to carefully consider the terms of the consolidation loan to ensure it’s the right choice for your financial situation. Debt consolidation can be a helpful strategy for those looking to streamline their debt repayment process and potentially lower their overall debt burden.

Increasing Income Sources

In order to accelerate debt repayment, it is crucial to explore various ways to increase your income. By generating more money, you can allocate additional funds towards paying off your debts faster, ultimately achieving financial freedom sooner.

Side Hustles and Part-Time Jobs

Negotiating a Raise or Promotion

Cutting Expenses

In order to pay off debt faster, it is essential to find ways to reduce expenses and free up more money for debt payments. By distinguishing between needs and wants, individuals can identify areas where they can cut back on spending and allocate those funds towards debt repayment.

Prioritizing Needs Over Wants

When cutting expenses, it’s important to prioritize needs over wants. Needs are essential for survival and well-being, while wants are things that are nice to have but not necessary. By focusing on reducing spending on wants, individuals can significantly increase the amount of money available for debt payments.

Reducing Recurring Expenses

One effective way to cut expenses is by reducing or eliminating recurring costs that can add up over time. By renegotiating bills or finding cheaper alternatives, individuals can save money and put it towards paying off debt.