Benefits of a Roth IRA sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

As we dive into the world of Roth IRAs, we uncover a treasure trove of financial wisdom and savvy investment strategies that can pave the way to a brighter financial future.

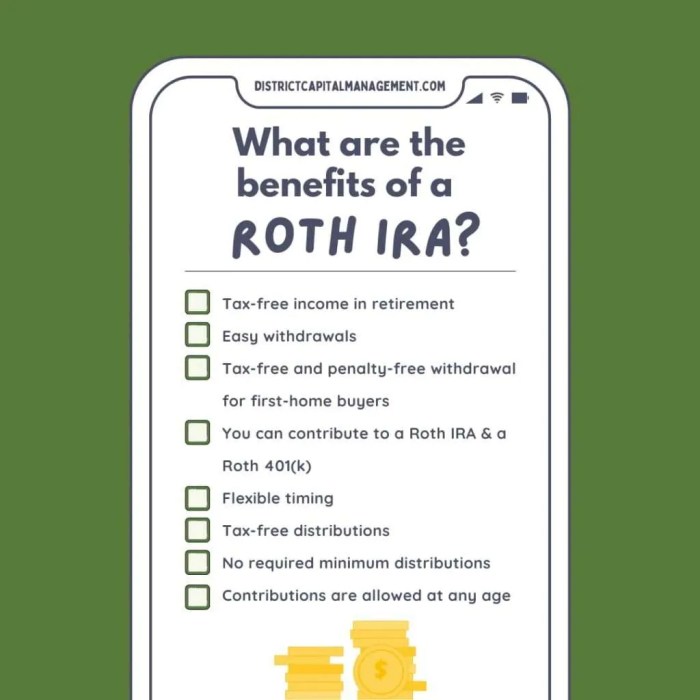

Introduction to Roth IRA

A Roth IRA is a retirement savings account that offers tax-free growth and tax-free withdrawals in retirement. Unlike a traditional IRA, contributions to a Roth IRA are made with after-tax dollars, meaning you don’t get a tax deduction upfront but can withdraw the money tax-free in retirement.

Differences from Traditional IRA

- Roth IRA contributions are made with after-tax dollars, while traditional IRA contributions are made with pre-tax dollars.

- Withdrawals from a Roth IRA in retirement are tax-free, whereas withdrawals from a traditional IRA are taxed as ordinary income.

- Roth IRAs have no required minimum distributions (RMDs) during the account owner’s lifetime, unlike traditional IRAs that have RMDs starting at age 72.

Eligibility Criteria

- To contribute to a Roth IRA, you must have earned income, such as wages, salaries, tips, or self-employment income.

- There are income limits for contributing to a Roth IRA, with phased-out eligibility for higher earners.

- Individuals can contribute up to a certain limit each year, with catch-up contributions allowed for those over 50 years old.

Tax Benefits of a Roth IRA

When it comes to saving for retirement, a Roth IRA offers some unique tax advantages that can help you grow your nest egg more effectively.

Contributions to a Roth IRA are made with after-tax dollars, meaning that you’ve already paid taxes on the money you put into the account. This may not seem like a benefit at first, but it becomes advantageous when you consider that all qualified withdrawals from a Roth IRA are tax-free. This includes not only your original contributions but also any earnings or investment growth over the years. This tax-free status can result in significant savings in the long run compared to traditional retirement accounts.

Tax-Free Growth of Investments

Investments held within a Roth IRA grow tax-free, allowing your money to compound without being subject to capital gains taxes or other investment-related taxes. This means that you can maximize your investment returns over time, as you won’t have to share a portion of your profits with the IRS when you withdraw funds in retirement.

Comparison with Other Retirement Accounts

When comparing the tax advantages of a Roth IRA with other retirement accounts like traditional IRAs or 401(k)s, the key difference lies in the tax treatment of contributions and withdrawals. While traditional retirement accounts offer tax-deferred growth, meaning you’ll pay taxes on both contributions and earnings when you withdraw funds in retirement, a Roth IRA provides tax-free withdrawals on both contributions and earnings for qualified distributions.

Overall, the tax benefits of a Roth IRA make it a powerful tool for retirement planning, offering the potential for tax-free growth and withdrawals that can enhance your financial security in retirement.

Withdrawal Rules and Benefits

When it comes to withdrawing funds from a Roth IRA, there are specific rules in place to ensure you maximize the benefits of this retirement account. Understanding these rules is crucial for making informed decisions about your financial future.

Roth IRAs offer the benefit of tax-free withdrawals during retirement. This means that once you reach retirement age and start taking distributions from your Roth IRA, you won’t have to pay any taxes on the money you withdraw. This can be a significant advantage, especially if you anticipate being in a higher tax bracket during retirement.

Tax-Free Withdrawals

- Withdrawals from a Roth IRA are tax-free as long as you meet certain criteria, such as being at least 59 and a half years old and having held the account for at least five years.

- Unlike traditional IRAs, Roth IRAs do not have required minimum distributions (RMDs) during the account holder’s lifetime, allowing you to let your investments grow tax-free for as long as you wish.

- Tax-free withdrawals can provide a significant source of income during retirement without the burden of additional taxes, allowing you to make the most of your savings.

Impact on Social Security Benefits

- Roth IRA withdrawals do not count as income for determining your Social Security benefits, which can be advantageous for retirees who rely on Social Security as a key source of income.

- By strategically planning your Roth IRA withdrawals, you can minimize the impact on your Social Security benefits and potentially maximize your overall retirement income.

Investment Flexibility and Options

When it comes to a Roth IRA, you’ve got some serious investment options at your fingertips. Let’s dive into the details.

Investment Options

In a Roth IRA, you can invest in a variety of assets such as stocks, bonds, mutual funds, ETFs, and even real estate investment trusts (REITs). This diversity allows you to create a well-balanced portfolio tailored to your risk tolerance and financial goals.

Flexibility of Managing Investments

One of the key perks of a Roth IRA is the flexibility it offers in managing your investments. You have the freedom to buy and sell assets within the account without incurring taxes on capital gains or dividends. This means you can actively adjust your portfolio to adapt to changing market conditions or your personal investment strategy.

Comparison with Other Retirement Accounts

Unlike traditional retirement accounts like 401(k)s or IRAs, Roth IRAs provide more investment choices and control. While employer-sponsored plans may limit your investment options to a selection of funds, a Roth IRA gives you the power to choose individual stocks and other assets directly. This level of control can be a game-changer for investors looking to customize their retirement savings to their liking.