Diving deep into the world of stock quotes, this introduction will take you on a journey filled with valuable insights and knowledge. Get ready to decode the numbers and symbols that make up a stock quote like a pro.

Get ready to learn about the components of a stock quote, the importance of stock quotes for investors, and how to navigate through the world of stock market data.

Understanding Stock Quotes

A stock quote is a snapshot of a stock’s current price and trading activity on the market. It provides valuable information to investors about the performance of a particular stock.

Components of a Stock Quote

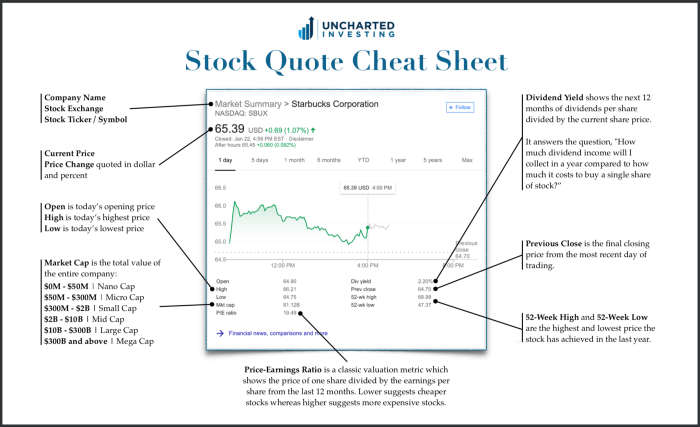

A stock quote typically includes the following components:

- Symbol: The unique abbreviation used to identify a specific stock on the market.

- Last Price: The price at which the stock was last traded.

- Change: The difference between the current price and the previous day’s closing price.

- Bid Price: The price at which buyers are willing to purchase the stock.

- Ask Price: The price at which sellers are willing to sell the stock.

- Volume: The total number of shares traded during a specific period.

Importance of Stock Quotes for Investors

Stock quotes are essential for investors as they provide real-time information on the performance of stocks, helping investors make informed decisions about buying or selling. By monitoring stock quotes, investors can track market trends, analyze stock movements, and assess the overall health of their investment portfolio.

Difference Between Bid Price, Ask Price, and Volume

Understanding the bid price, ask price, and volume in a stock quote is crucial for investors:

- Bid Price: This is the maximum price that a buyer is willing to pay for a stock. It represents the demand for the stock in the market.

- Ask Price: This is the minimum price that a seller is willing to accept for a stock. It reflects the supply of the stock in the market.

- Volume: Volume indicates the total number of shares that have been traded during a specific period. It helps investors gauge the level of activity and interest in a particular stock.

Stock Symbol and Company Information

When looking at a stock quote, one of the key elements you will see is the stock symbol. This is a unique series of letters assigned to a particular company’s stock that is traded on the stock exchange. The stock symbol serves as a shorthand way to identify a company and its stock in the financial markets.

Identifying a Stock Using Its Symbol

- Stock symbols are typically short and easy to remember. For example, Apple Inc. is represented by the stock symbol AAPL.

- You can find a stock’s symbol by searching for the company’s name on financial websites or using stock market apps.

- When looking at a stock quote, the symbol is usually displayed prominently along with the stock price.

Finding Additional Company Information

- Once you have identified the stock symbol, you can gather more information about the company by researching its profile on financial websites.

- Company information may include details such as the company’s industry, headquarters location, key executives, financial performance, and recent news or developments.

- This additional information can help you assess the company’s health and future prospects, which can be valuable when making investment decisions.

Significance of Company Information in a Stock Quote

- Company information included in a stock quote provides context and background about the stock you are interested in.

- Understanding the company’s business operations, competitive position, and financial health can give you insights into the stock’s potential performance.

- Investors often use company information to evaluate the risks and opportunities associated with investing in a particular stock.

Price and Volume Information

When looking at a stock quote, you’ll typically see the price and volume information displayed prominently. This data is crucial for investors to understand how a stock is performing in the market.

Price changes in a stock quote indicate how much the price of a stock has moved since the previous trading day. Positive price changes mean the stock has increased in value, while negative changes indicate a decrease. These changes are usually expressed as a percentage to show the magnitude of the movement.

Volume fluctuations, on the other hand, refer to the number of shares traded during a given time period. High volume usually accompanies significant price movements, indicating strong investor interest. Low volume, on the other hand, may suggest less interest in the stock.

Closing Price vs. Opening Price

The closing price in a stock quote represents the final price at which a stock traded at the end of the trading day. This price is crucial as it reflects the sentiment of investors at the close of the market.

The opening price, on the other hand, is the price at which a stock started trading at the beginning of the trading day. By comparing the closing price with the opening price, investors can gauge how the stock performed throughout the trading day. A higher closing price than the opening price indicates a bullish trend, while a lower closing price suggests a bearish trend.

Reading Stock Charts

When it comes to understanding stock performance, reading stock charts can provide valuable insights into how a stock has been performing over a period of time. Stock charts display the price movement of a stock in a visual format, allowing investors to analyze trends, patterns, and make informed decisions.

Types of Stock Charts

- Line Charts: Line charts are the most basic type of stock chart, showing the closing price of a stock over a specific period of time. They provide a clear representation of the overall trend of a stock.

- Bar Charts: Bar charts display the open, high, low, and close prices of a stock for a given time frame. They offer more detailed information compared to line charts.

- Candlestick Charts: Candlestick charts provide a visual representation of price movements, showing the open, high, low, and close prices in a candlestick shape. They are useful for identifying patterns and trends in stock performance.

Analyzing Stock Performance with Stock Charts

Stock charts can help investors analyze stock performance by identifying trends, support and resistance levels, and patterns that may indicate potential buy or sell opportunities. By looking at stock charts, investors can make more informed decisions based on historical price movements and market trends.

Tracking Stock Market Indices

In the world of stock market investing, tracking stock market indices is crucial for understanding the overall performance of the market as a whole. Stock market indices are used to measure and report the value of a specific section of the stock market, representing a group of stocks. They provide investors with a general idea of how the market is performing at any given time.

Significance of Stock Market Indices

- Stock market indices serve as benchmarks to compare the performance of individual stocks or portfolios against the overall market.

- They help investors gauge market trends and sentiment, providing valuable insights for making investment decisions.

- Indices can also be used to track the performance of specific sectors or industries within the market.

Representation in Stock Quotes

- Stock market indices are typically represented by abbreviations or symbols, such as the S&P 500, NASDAQ, or Dow Jones Industrial Average (DJIA).

- They are often displayed alongside individual stock prices in stock quotes, showing the overall direction of the market.

- Changes in stock market indices can impact the prices of individual stocks, as they reflect broader market trends.

Relationship with Individual Stock Prices

- While stock market indices provide a general overview of the market, they can also influence the movement of individual stock prices.

- Strong performance in a stock market index can lead to increased investor confidence, driving up the prices of individual stocks within that index.

- Conversely, a decline in a stock market index may signal market instability, causing a decrease in the prices of individual stocks.