Diving into the world of investment diversification opens up a realm of possibilities where risks can be mitigated and returns optimized. Let’s explore the art of spreading your investments wisely across various assets for financial success.

As we delve deeper, you’ll uncover the secrets behind creating a diversified portfolio that stands resilient against market fluctuations.

Importance of Investment Diversification

Investment diversification is key to managing risk and maximizing returns in a portfolio. By spreading investments across different assets, you can reduce the impact of volatility in any single investment.

Reducing Risk through Diversification

- Diversifying across industries: Investing in various industries helps mitigate the risk of sector-specific downturns. For example, if one sector experiences a downturn, investments in other sectors can balance out the losses.

- Diversifying across asset classes: Allocating investments in different asset classes such as stocks, bonds, real estate, and commodities can provide a buffer against market volatility. When one asset class underperforms, others may perform better, thus reducing overall portfolio risk.

Benefits of Spreading Investments

- Minimizing losses: Diversification helps protect against significant losses in a single investment by spreading risk across multiple assets.

- Enhancing returns: While diversification may limit the potential for outsized gains, it also helps to smooth out returns over time, providing more consistent and stable growth.

- Increasing flexibility: Having a diversified portfolio allows investors to adapt to changing market conditions and take advantage of opportunities in different sectors or asset classes.

Strategies for Investment Diversification

When it comes to diversifying investments, there are several strategies that investors can employ to reduce risk and maximize returns. Diversification involves spreading investments across different assets to minimize the impact of any single investment’s performance on the overall portfolio.

Diversification Methods

- Diversification within a Single Asset Class:

- Investors can diversify within a single asset class by investing in a variety of securities within that class. For example, within the stock market, investors can spread their investments across different industries or sectors to reduce exposure to any one sector’s risks.

- Diversification across Multiple Asset Classes:

- Another strategy is to diversify across multiple asset classes, such as stocks, bonds, real estate, and commodities. This approach helps reduce overall portfolio risk because different asset classes tend to perform differently under various market conditions.

Optimal Diversification Techniques

- Assessing Risk Tolerance:

- Investors should consider their risk tolerance when determining the optimal diversification strategy. Those with a lower risk tolerance may opt for a more conservative approach with a higher allocation to less volatile assets like bonds, while those with a higher risk tolerance may allocate more to equities.

- Setting Financial Goals:

- Investors should align their diversification strategy with their financial goals. For example, if the goal is long-term growth, a more aggressive diversification approach with a higher allocation to equities may be suitable. On the other hand, investors with a goal of capital preservation may opt for a more conservative allocation.

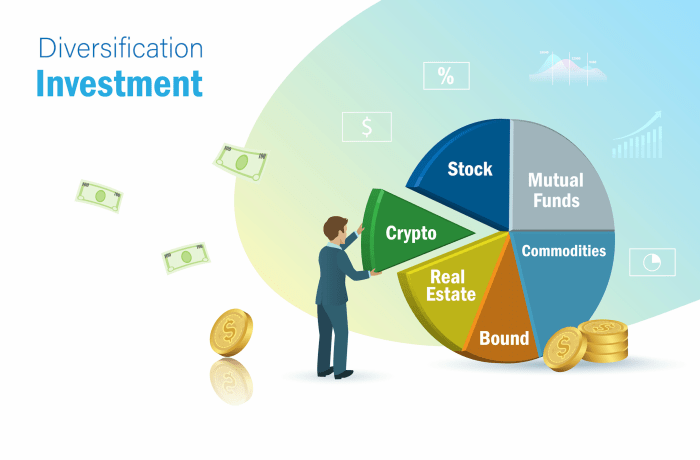

Asset Classes for Diversification

When it comes to diversifying your investment portfolio, it’s essential to consider different asset classes. Each asset class has its own unique characteristics and risk profiles, which can help you achieve a well-rounded and balanced portfolio.

Stocks

Stocks represent ownership in a company and are known for their potential for high returns. However, they also come with higher volatility and risk compared to other asset classes. Including a mix of different stocks in your portfolio can help spread out the risk.

Bonds

Bonds are debt securities issued by governments or corporations. They are considered less risky than stocks but offer lower returns. Bonds can provide stability and income to your portfolio, especially during times of market volatility.

Real Estate

Investing in real estate can provide a hedge against inflation and offer potential for long-term growth. Real estate investments can include physical properties, real estate investment trusts (REITs), and real estate crowdfunding platforms.

Commodities

Commodities such as gold, silver, oil, and agricultural products can help diversify your portfolio and provide a hedge against inflation. They tend to have low correlation with stocks and bonds, making them a valuable addition to a well-diversified portfolio.

Alternative Investments

Alternative investments like hedge funds, private equity, and venture capital offer unique opportunities for diversification. These investments can have higher barriers to entry and liquidity compared to traditional asset classes but can provide additional diversification benefits.

Risks and Challenges in Diversification

Investing in a diversified portfolio can help manage risks, but it also comes with its own set of challenges that need to be addressed.

Common Pitfalls to Avoid in Diversifying Investments

- Over-diversification: While diversification is key, spreading your investments too thin across too many assets can dilute potential returns.

- Correlation Risks: Investing in assets that are highly correlated can lead to losses across the board when one sector or market falters.

- Ignoring Asset Quality: Focusing solely on quantity rather than the quality of assets can expose your portfolio to unnecessary risks.

- Market Timing: Trying to time the market by constantly buying and selling assets can lead to poor investment decisions.

How Economic Conditions or Market Events Impact Diversified Portfolios

Economic downturns or sudden market shifts can affect different asset classes in various ways, potentially leading to losses in certain sectors while others remain stable.

Strategies for Managing Risks Associated with Over-Diversification

- Focus on Core Holdings: Identify key assets that align with your investment goals and concentrate on building a strong foundation around them.

- Regular Portfolio Review: Periodically reassess your portfolio to ensure that your investments are in line with your risk tolerance and financial objectives.

- Rebalancing: Adjust your portfolio by selling overperforming assets and buying underperforming ones to maintain the desired asset allocation.

- Seek Professional Advice: Consult with financial advisors or experts to get guidance on fine-tuning your diversified portfolio for optimal performance.