Venture capital funds set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From defining the purpose of these funds to exploring their impact on startups, this guide dives deep into the world of venture capital with an American high school hip style twist.

Overview of Venture Capital Funds

Venture capital funds are investment funds that provide financing to startup companies and small businesses that have the potential for high growth. The main purpose of venture capital funds is to earn a return on their investments by helping these companies grow and succeed.

Differences from Other Investment Funds

Venture capital funds differ from other types of investment funds, such as mutual funds or hedge funds, in several key ways:

- Venture capital funds typically invest in early-stage companies with high growth potential, while other funds may focus on more established companies.

- Venture capital funds often take an active role in the companies they invest in, providing not just capital but also strategic guidance and mentorship.

- Unlike traditional investment funds, venture capital funds have a higher risk tolerance and are willing to invest in companies that may not have a proven track record or profitability.

Examples of Successful Companies Funded by Venture Capital

Many well-known companies have received funding from venture capital firms, helping them grow into the successful businesses they are today. Some examples include:

-

Google

: Founded in 1998 with initial funding from venture capital firm Kleiner Perkins, Google has grown into one of the largest and most valuable tech companies in the world.

-

Facebook

: Started in a Harvard dorm room in 2004, Facebook received early funding from Accel Partners and has since become a social media giant.

-

Amazon

: Jeff Bezos founded Amazon in 1994 with funding from venture capital firm Kleiner Perkins, paving the way for the e-commerce giant we know today.

How Venture Capital Funds Work

Venture capital funds play a crucial role in supporting startups and innovative businesses by providing them with the necessary funding to grow and scale their operations. Let’s dive into the workings of venture capital funds.

Typical Structure of a Venture Capital Fund

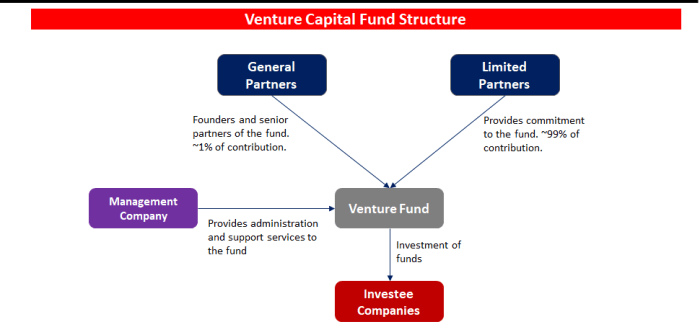

A typical venture capital fund is structured with a general partner (GP) who manages the fund and limited partners (LPs) who invest money into the fund. The GP is responsible for making investment decisions on behalf of the fund, while the LPs provide the capital. Additionally, there may be other professionals involved in the fund management team, such as analysts, associates, and administrative staff.

Raising Capital for a Venture Capital Fund

Raising capital for a venture capital fund involves reaching out to potential investors, often high-net-worth individuals, institutional investors, and corporations. The GP presents the investment strategy, track record, and potential returns to attract investors to commit capital to the fund. This process usually requires a significant amount of networking, pitching, and due diligence to secure commitments from LPs.

Stages of Investment in a Startup by Venture Capital Funds

Venture capital funds typically invest in startups through different stages of development, known as rounds. These rounds include seed funding, early-stage funding, and later-stage funding. In each round, the startup receives capital to fuel its growth, with the venture capital fund taking an equity stake in the company. As the startup progresses and achieves milestones, it may raise additional funding rounds to support further expansion and development.

Benefits and Risks of Venture Capital Funds

When it comes to venture capital funds, there are both benefits and risks involved for startups and investors alike. Let’s dive into the details.

Benefits for Startups

- Venture capital funds provide startups with access to substantial amounts of capital that may be difficult to obtain through traditional bank loans. This infusion of funds can help startups scale their operations and bring innovative products or services to market.

- Aside from funding, venture capital firms often provide valuable mentorship and guidance to startups. They offer expertise, industry connections, and strategic advice that can help startups navigate challenges and accelerate growth.

- By securing funding from venture capital funds, startups also gain credibility in the eyes of other investors and potential partners. This can open up additional opportunities for partnerships, collaborations, and future funding rounds.

Risks Associated with Venture Capital Funding

- For startups, one of the main risks of venture capital funding is the loss of control. Venture capitalists typically require a significant equity stake in the company in exchange for their investment, which means startups may have to relinquish some decision-making power.

- Another risk is the pressure to achieve rapid growth and high returns. Venture capital firms expect a substantial return on their investment within a relatively short timeframe, which can lead to increased stress and a focus on short-term gains rather than long-term sustainability.

- From the investor’s perspective, there is always the risk of the startup failing to meet expectations and not generating the anticipated returns. Not all startups succeed, and investors may lose their entire investment if a funded company goes under.

Advantages and Disadvantages of Venture Capital Funding vs. Traditional Bank Loans

- Advantages of Venture Capital Funding:

- Venture capital funding does not require collateral, unlike bank loans, making it accessible to startups without significant assets.

- Venture capitalists often bring industry expertise and connections to the table, which can benefit startups beyond just the financial support.

- Investors in venture capital funds are typically more willing to take risks on innovative ideas and early-stage companies compared to traditional banks.

- Disadvantages of Venture Capital Funding:

- Venture capital funding can be more expensive in the long run due to the equity stake given up by startups in exchange for the investment.

- There is a higher level of scrutiny and pressure from venture capitalists to deliver on growth targets, which may not align with the startup’s long-term vision.

- Competition for venture capital funding can be fierce, and not all startups are able to secure this type of financing.

Impact of Venture Capital Funds on Startups

Venture capital funds play a crucial role in the growth and success of startups by providing the necessary financial resources to fuel their development. This funding not only helps startups scale and expand but also enables them to access valuable networks and expertise that can drive innovation and market penetration.

Role of Venture Capital in Startup Growth

- Venture capital funding allows startups to invest in research and development, hire top talent, and expand their operations.

- It enables startups to accelerate their growth trajectory and compete more effectively in the market.

- Venture capitalists often provide strategic guidance and mentorship to startup founders, leveraging their experience and industry connections.

Influence of Venture Capital Funding on Strategic Decisions

- Startup founders often face pressure to deliver high returns to venture capitalists, leading to strategic decisions focused on rapid growth and market dominance.

- Venture capital funding can influence product development, marketing strategies, and expansion plans, shaping the overall direction of the startup.

- Founders may need to strike a balance between meeting investor expectations and maintaining the long-term sustainability of the business.

Examples of Startups Transformed by Venture Capital Funds

- Uber: The ride-sharing giant revolutionized the transportation industry with the help of significant venture capital funding, disrupting traditional taxi services worldwide.

- Airbnb: This accommodation marketplace transformed the hospitality sector by connecting travelers with unique lodging options, thanks to strategic investments from venture capitalists.

- SpaceX: Elon Musk’s aerospace company redefined space exploration through innovative technologies and ambitious missions funded by venture capital partners.