Dive into the world of international investments, where opportunities abound and risks are carefully navigated. From diversifying your portfolio to exploring different types of investments, this journey promises excitement and growth.

Let’s explore the benefits, types, factors influencing decisions, and strategies for managing risks in the realm of international investments.

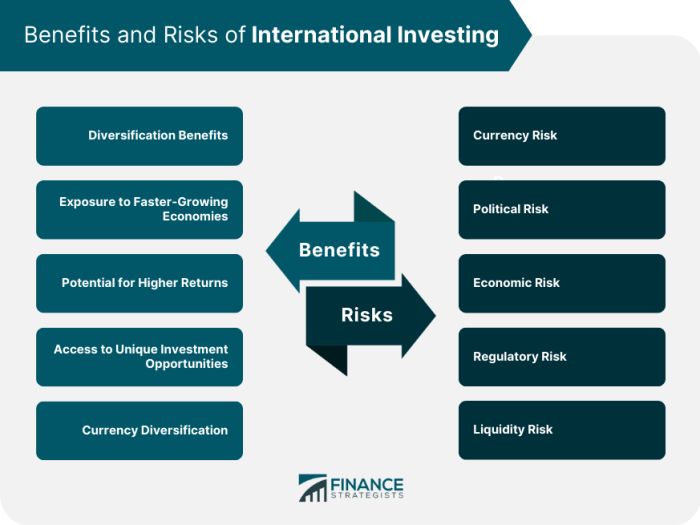

Benefits of International Investments

Investing internationally can bring a range of benefits to your portfolio. Diversifying your investments across different countries and regions can help spread risk and potentially enhance returns.

Diversification of Portfolio

When you invest internationally, you are not only exposed to the performance of your domestic market but also to the growth and trends of other economies. This diversification can help reduce the impact of any downturn in a single market, providing a more stable return on investment.

Hedging Against Domestic Market Risks

International investments can act as a hedge against risks that are specific to your domestic market. For example, if there is a recession in your home country, investments in other countries may not be affected in the same way, helping to balance out any losses.

Potential for Higher Returns

In some cases, international investments can offer higher returns compared to domestic investments. Emerging markets, for instance, may experience rapid growth and provide lucrative opportunities for investors seeking greater returns. By tapping into these markets, you could potentially boost your overall investment performance.

Types of International Investments

When it comes to international investments, there are several options to consider depending on your investment goals and risk tolerance. Let’s explore the different types of international investments available to investors.

Foreign Stocks

Foreign stocks are shares of companies based in countries outside of your home country. Investing in foreign stocks can provide diversification and exposure to different markets, industries, and currencies. However, it also comes with currency exchange rate risks and geopolitical factors that can impact returns.

Bonds

International bonds are debt securities issued by foreign governments, municipalities, or corporations. They can offer fixed income opportunities and diversification benefits. Investors should be aware of credit risk, interest rate fluctuations, and currency risk when investing in international bonds.

Mutual Funds

International mutual funds pool money from multiple investors to invest in a diversified portfolio of foreign securities. These funds are managed by professional fund managers who make investment decisions on behalf of investors. Investors should consider fund expenses, performance history, and investment objectives before investing in international mutual funds.

ETFs

Exchange-traded funds (ETFs) are similar to mutual funds but trade on stock exchanges like individual stocks. International ETFs provide a convenient way to gain exposure to foreign markets with lower costs and intraday trading flexibility. However, investors should be aware of liquidity, tracking error, and expense ratios associated with international ETFs.

Direct vs. Indirect Investments

Direct investments involve owning foreign assets directly, such as buying shares of a foreign company or property in another country. Indirect investments, on the other hand, involve investing in funds or securities that hold international assets. Direct investments may offer more control but also come with higher risks and costs compared to indirect investments.

Risks Associated with International Investments

– Currency risk: Fluctuations in exchange rates can impact the value of international investments.

– Political risk: Changes in government policies, regulations, or instability in foreign countries can affect investment returns.

– Market risk: Volatility in global markets can lead to fluctuations in the value of international investments.

– Liquidity risk: Some international markets may have lower trading volumes, making it difficult to buy or sell investments at desired prices.

Overall, international investments can offer diversification benefits and growth opportunities, but investors should carefully consider the risks and potential rewards associated with each type of investment before making decisions.

Factors Influencing International Investment Decisions

When making decisions on international investments, several factors come into play that can significantly impact the success or failure of the venture. These factors include political stability, economic indicators, cultural differences, and legal systems. Understanding how each of these elements influences investment decisions is crucial for investors looking to expand their portfolios globally.

Political Stability Impact

Political stability in a foreign country plays a vital role in determining the feasibility of international investments. Countries with stable governments and favorable political climates often attract more investments due to the reduced risk of sudden policy changes, government instability, or conflict. On the other hand, nations with political unrest, corruption, or frequent changes in leadership may deter investors due to the increased level of uncertainty and associated risks.

Economic Indicators Role

Economic indicators such as GDP growth, inflation rates, and exchange rates are essential factors that investors consider when making international investment decisions. A country with a stable and growing GDP, low inflation rates, and favorable exchange rates tends to be more attractive to investors. These indicators provide insights into the economic health of a country, its growth potential, and the stability of its currency, influencing investment strategies and decisions.

Cultural Differences and Legal Systems Influence

Cultural differences and legal systems can also significantly impact international investment strategies. Understanding the cultural norms, business practices, and legal frameworks of a foreign country is essential for investors to navigate successfully in a new market. Differences in language, customs, business etiquette, and legal regulations can pose challenges or opportunities for investors, shaping their approach and operations in the international arena.

Strategies for Managing International Investment Risks

When investing internationally, it is crucial to have strategies in place to manage various risks that may arise. This includes techniques for hedging currency risk, diversification strategies, and considering the impact of geopolitical events on investments.

Hedging Currency Risk

Currency risk is one of the key risks when investing internationally, as exchange rate fluctuations can significantly impact returns. One common technique to hedge currency risk is through the use of forward contracts. These contracts allow investors to lock in an exchange rate for a future date, reducing the uncertainty associated with currency fluctuations.

Diversification Strategies

Diversification is another important strategy to minimize country-specific risks in international investments. By spreading investments across different countries and regions, investors can reduce the impact of any adverse events in a single country. This can be achieved through investing in a mix of asset classes, industries, and geographic regions.

Geopolitical Events and Risk Management

Geopolitical events such as wars, political instability, or trade disputes can have a significant impact on international investments. To manage these risks, investors should stay informed about global events and their potential impact on markets. One way to mitigate geopolitical risks is by diversifying investments across countries with different political landscapes and economic structures.