When it comes to making money, passive income ideas offer a unique opportunity to earn without constantly trading time for dollars. From real estate to online businesses, there are various avenues to explore in the realm of passive income. Let’s delve into the world of passive income ideas and discover how you can start building a more secure financial future today.

In this article, we will explore different types of passive income streams, successful ventures, and the advantages of incorporating passive income into your financial strategy.

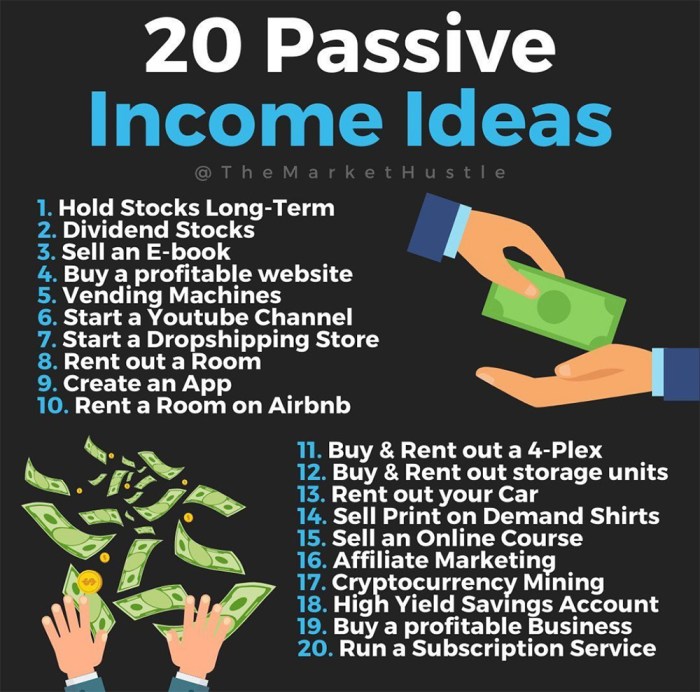

Passive Income Ideas

Earning passive income is a great way to generate money without actively working for it. Here are some popular passive income streams to consider:

1. Real Estate Investments

Investing in rental properties or real estate crowdfunding platforms can provide a steady stream of passive income through rental payments or property appreciation.

2. Dividend Stocks

By investing in dividend-paying stocks, you can earn passive income through regular dividend payments from profitable companies.

3. Create an Online Course

Developing and selling an online course on a topic you are knowledgeable about can generate passive income through course sales and enrollments.

4. Affiliate Marketing

Promoting products or services through affiliate links on your website or social media can earn you commissions for every sale or lead generated.

5. Peer-to-Peer Lending

Investing in peer-to-peer lending platforms allows you to earn passive income through interest payments on loans funded to borrowers.

Benefits of Earning Passive Income

- Financial Freedom: Passive income can provide financial stability and freedom by diversifying income sources.

- Flexibility: Passive income streams allow you to earn money without being tied to a traditional 9-5 job.

- Scalability: Many passive income ideas can be scaled up to increase earnings over time.

- Generational Wealth: Building passive income streams can create a legacy of wealth for future generations.

Real Estate

Real estate can be a lucrative source of passive income through various strategies such as rental properties, real estate investment trusts (REITs), and real estate crowdfunding. Investing in real estate allows individuals to generate income through rental payments, property appreciation, and tax benefits.

Rental Properties vs. Real Estate Investment Trusts (REITs)

- Rental Properties:

- Owning rental properties involves purchasing physical real estate and renting it out to tenants.

- Landlords can generate passive income through monthly rental payments from tenants.

- Property owners are responsible for property maintenance, repairs, and tenant management.

- Rental properties offer the potential for higher returns but require more active involvement.

- Real Estate Investment Trusts (REITs):

- REITs are companies that own, operate, or finance income-generating real estate across different sectors.

- Investors can buy shares of REITs, which provide regular dividend payments and potential capital appreciation.

- REITs offer diversification, liquidity, and passive income without the need for property management.

- Investing in REITs allows individuals to benefit from real estate market performance without direct ownership of properties.

Generating Passive Income through Real Estate Crowdfunding

Real estate crowdfunding platforms enable investors to pool their resources to invest in real estate projects. Here’s how it works:

- Investors can browse different real estate opportunities on crowdfunding platforms and select projects to invest in.

- By investing in real estate crowdfunding, individuals can gain access to a diversified portfolio of properties without the need for significant capital.

- Passive income is generated through rental income, property appreciation, or profit-sharing from real estate projects.

- Real estate crowdfunding offers flexibility, transparency, and the opportunity to invest in various real estate projects with minimal hassle.

Investments

Investing is a great way to generate passive income over time. By putting your money into different assets, you can earn returns without actively working for it. Let’s explore some investment options for generating passive income.

Dividend Investing

Dividend investing involves buying shares of companies that pay out dividends to their shareholders. These dividends are a portion of the company’s profits distributed to investors. Here are some benefits of dividend investing:

- Regular Income: Dividend payments provide a steady stream of income.

- Compound Growth: Reinvesting dividends can accelerate wealth accumulation.

- Lower Risk: Dividend-paying stocks are often more stable and less volatile.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with investors willing to lend money for a return. As an investor, you can earn passive income through interest payments. Here’s how peer-to-peer lending can be a passive income opportunity:

- Diversification: Spread your investment across multiple loans to reduce risk.

- Automated Investing: Some platforms offer automated tools to simplify the lending process.

- Potential High Returns: Earn higher interest rates compared to traditional savings accounts.

Online Business

Creating an online business can be a lucrative way to generate passive income. With the right strategy and execution, you can build a successful online venture that brings in money even while you sleep.

Blogging for Passive Income

- Choose a niche that you are passionate about and that has the potential for profitability.

- Create high-quality and valuable content consistently to attract and retain readers.

- Monetize your blog through affiliate marketing, sponsored content, and selling digital products.

- Utilize strategies to increase organic traffic to your blog and improve your visibility online.

Selling Digital Products Online

- Identify a digital product that solves a problem or meets a need in your target market.

- Create a high-quality digital product such as an ebook, online course, or software.

- Set up an online store or platform to sell your digital products and automate the sales process.

- Promote your digital products through email marketing, social media, and other online channels to reach a wider audience.

Passive Income through Royalties

Creating passive income through royalties involves earning money from the ongoing usage or sale of creative works, such as books, music, art, or inventions, without actively being involved in the work. This stream of income can provide long-term financial benefits with minimal effort once the initial work is completed.

Royalties are typically paid based on a percentage of revenue generated from the use or sale of the creative work. This can come from various sources, such as book sales, music streaming, licensing agreements, or product sales. The creator or owner of the work receives a portion of the earnings as compensation for allowing others to use or benefit from their creation.

Popular Platforms for Earning Royalties

- Amazon Kindle Direct Publishing: Authors can earn royalties from eBook sales on Amazon’s platform.

- Spotify and Apple Music: Musicians can earn royalties from their music streams on these popular music streaming services.

- Shutterstock and Adobe Stock: Photographers and artists can earn royalties by licensing their images and artwork on these stock photography platforms.

- Patents and Inventions: Inventors can earn royalties by licensing their patented inventions for others to use or manufacture.