Get ready to dive into the world of Understanding income statements. This is where the financial magic happens, and we’re here to break it down for you in a cool, easy-to-understand way.

From the importance of income statements to analyzing key ratios, we’ve got you covered with all the must-know info.

Importance of Income Statements

Income statements are like the superhero capes of the business world – they reveal the financial performance of a company and help stakeholders make informed decisions. Without income statements, businesses would essentially be flying blind, not knowing if they’re making money or drowning in debt.

Income statements serve as the financial report card of a company, showing how much revenue was generated, the expenses incurred, and ultimately, the profitability of the business. Investors and analysts rely on income statements to assess the financial health of a company, make investment decisions, and predict future performance.

Role in Financial Reporting

Income statements play a crucial role in financial reporting by providing a snapshot of a company’s financial performance over a specific period. They help investors and analysts understand how well a company is generating revenue, managing expenses, and ultimately, turning a profit. By analyzing income statements, stakeholders can gauge the efficiency and effectiveness of a company’s operations and make informed decisions about their investments.

- Revenue Generation: Income statements show the total revenue earned by a company, giving investors insights into the sales performance and market presence of the business.

- Expense Management: By detailing the various expenses incurred by a company, income statements help investors evaluate how efficiently a company is managing its costs and resources.

- Profitability Analysis: The bottom line of an income statement, the net income, indicates the overall profitability of a company. Investors use this figure to assess the financial health and sustainability of the business.

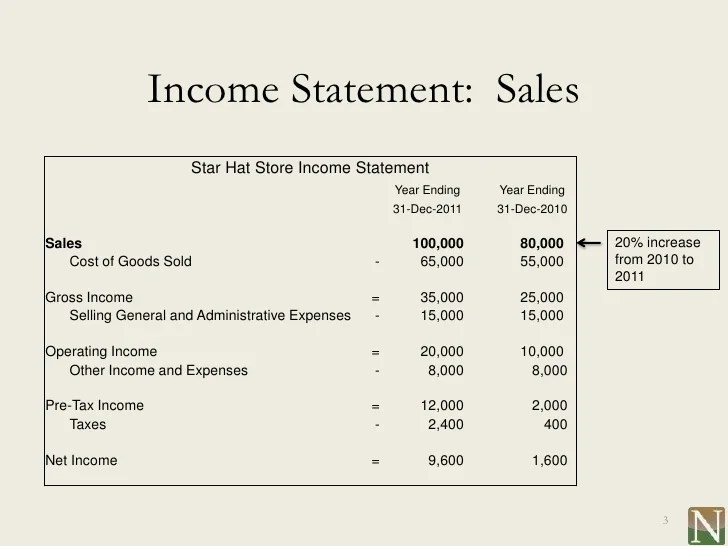

Components of an Income Statement

Income statements typically consist of several key components that provide insight into a company’s financial performance over a specific period of time.

Revenue: This represents the total amount of money generated from the sale of goods or services. It is the top line of the income statement and is crucial for assessing a company’s ability to generate income.

Expenses: These are the costs incurred by a company in order to generate revenue. Expenses can include items such as salaries, rent, utilities, and supplies. Managing expenses effectively is essential for improving profitability.

Net Income: Also known as the bottom line, net income is the amount of profit a company has after deducting all expenses from its revenue. It is a key indicator of a company’s financial health and overall performance.

Revenue

Revenue is a vital component of an income statement as it reflects the core business activities of a company. It includes all income generated from selling goods or services to customers. Revenue is crucial for assessing a company’s ability to generate profits and grow its business.

- Revenue can be further categorized into operating revenue and non-operating revenue. Operating revenue is generated from primary business activities, while non-operating revenue comes from secondary sources such as investments or asset sales.

- Formula:

Revenue = Number of Units Sold x Price per Unit

Expenses

Expenses are the costs incurred by a company to generate revenue and operate the business. Managing expenses effectively is essential for maintaining profitability and financial stability.

- Common types of expenses include operating expenses (e.g., salaries, rent, utilities), cost of goods sold (direct costs related to producing goods), and non-operating expenses (e.g., interest payments).

- Formula:

Expenses = Cost of Goods Sold + Operating Expenses

Net Income

Net income is the final amount left after subtracting all expenses from total revenue. It is a key metric for assessing a company’s profitability and financial performance.

- A positive net income indicates that a company is profitable, while a negative net income suggests losses.

- Formula:

Net Income = Revenue – Expenses

Reading and Analyzing Income Statements

Income statements are crucial financial documents that provide insights into a company’s profitability and overall financial health. When analyzing an income statement, it’s important to look at key figures and ratios to understand the company’s performance.

To interpret the information presented in an income statement, start by examining the revenue, expenses, and net income figures. Revenue represents the total amount of money generated from sales, while expenses consist of all the costs incurred to generate that revenue. Net income is the final figure that shows the company’s profit after deducting all expenses from revenue.

Key Ratios for Analysis

- Profit Margin: Calculated by dividing net income by total revenue, this ratio shows how much of each dollar in revenue translates to profit.

- Return on Assets (ROA): This ratio measures how effectively a company is using its assets to generate profit, calculated by dividing net income by total assets.

- Earnings Per Share (EPS): Indicates the amount of profit allocated to each outstanding share of common stock, calculated by dividing net income by the number of outstanding shares.

Common Trends and Red Flags

- Consistent Growth: Analysts look for steady revenue growth, increasing profit margins, and improving return on assets over time as positive trends.

- Declining Margins: A consistent decline in profit margins or negative net income can indicate operational inefficiencies or declining demand for the company’s products/services.

- Unusual Expenses: Large one-time expenses or irregular items that significantly impact net income may raise concerns about the company’s financial health and transparency.

Importance of Accurate Reporting

Accurate reporting in income statements plays a crucial role in providing stakeholders with a clear and truthful picture of a company’s financial performance. It ensures transparency, reliability, and trust in the information presented.

Implications of Errors or Misleading Information

Inaccuracies in income statements can have serious consequences on decision-making processes. For example, if revenues are overstated or expenses are understated, it can falsely inflate the profitability of a company, leading to misguided investment decisions or strategic planning. On the other hand, if key financial metrics are misrepresented, it can result in regulatory penalties, loss of investor confidence, and even legal repercussions.

Examples of Impact on Decision-Making Processes

- Incorrect revenue recognition: Inflating revenue figures can give a false impression of a company’s growth and financial health, leading investors to make poor investment choices.

- Understating expenses: Misleading information about expenses can distort the true cost structure of a company, impacting pricing strategies and profitability analysis.

- Manipulation of earnings: Falsifying earnings can create a distorted view of a company’s performance, influencing stock prices and investor sentiment.