How to create a budget dives into the world of financial planning with a fresh and engaging approach, perfect for those looking to take control of their finances. From understanding the importance of budgeting to managing debt and savings, this guide covers it all.

Understand the Importance of Budgeting

Creating a budget is crucial for effective financial planning. It provides a roadmap for managing your money wisely and achieving your financial goals.

Benefits of Budgeting

- Helps in tracking income and expenses: A budget allows you to see where your money is coming from and where it is going, helping you make informed financial decisions.

- Aids in setting financial goals: By creating a budget, you can prioritize your spending and saving towards short-term goals like a vacation or long-term goals like retirement.

- Prevents overspending: Budgeting helps you control your spending habits and avoid going into debt by ensuring you live within your means.

- Provides a sense of financial security: Knowing where your money is going gives you peace of mind and reduces financial stress.

Managing Expenses Effectively

- Identify your needs vs. wants: A budget helps you differentiate between essential expenses and discretionary spending, allowing you to allocate funds accordingly.

- Plan for emergencies: By budgeting for unexpected expenses, you can build an emergency fund to cover any unforeseen financial setbacks.

- Adjust and adapt: Regularly reviewing and adjusting your budget based on changing circumstances ensures that you stay on track to meet your financial goals.

Setting Financial Goals

Setting financial goals is a crucial step in creating a budget that works for you. By determining and prioritizing your financial goals, you can effectively manage your money and work towards achieving the life you desire. It is essential to set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) financial goals to ensure that they are clear, attainable, and aligned with your overall financial plan.

When you align your financial goals with your budget, you are more likely to stay focused, track your progress, and make informed financial decisions for a brighter financial future.

Steps to Determine and Prioritize Financial Goals

- Reflect on your values and priorities to identify what matters most to you.

- Set specific financial goals that are measurable and achievable within a certain timeframe.

- Prioritize your goals based on urgency and importance to guide your budgeting decisions.

Significance of SMART Financial Goals

- Specific: Clearly define your goals to avoid ambiguity and ensure a targeted approach.

- Measurable: Establish criteria to track your progress and know when you have achieved your goals.

- Achievable: Set realistic goals that you can attain with your current resources and capabilities.

- Relevant: Ensure that your goals align with your values and overall financial plan for meaningful progress.

- Time-bound: Set deadlines for your goals to create a sense of urgency and motivation for action.

Aligning Financial Goals with Budget for Better Money Management

- Create a budget that allocates funds towards your financial goals to ensure they are prioritized in your spending.

- Regularly review your budget to track progress towards your goals and make adjustments as needed.

- Make informed financial decisions based on your budget to stay on track and achieve your desired outcomes.

Assess Income and Expenses: How To Create A Budget

When creating a budget, it’s crucial to have a clear understanding of your income and expenses. This involves tracking your sources of income and categorizing your expenses to ensure you have an accurate picture of your financial situation.

Tracking Income

- Start by documenting all sources of income, including wages, salaries, bonuses, and any other earnings.

- Consider including income from side hustles, investments, rental properties, or any other additional sources.

- Regularly update your income records to reflect any changes or fluctuations in your earnings.

Categorizing Expenses

- Differentiate between fixed expenses (such as rent, mortgage, car payments) that remain constant each month.

- Identify variable expenses (like groceries, utilities, entertainment) that may fluctuate from month to month.

- Track discretionary spending, which includes non-essential purchases like dining out, shopping, or travel.

Importance of Documentation

- Accurately documenting your income and expenses is essential for creating a realistic budget.

- Having a clear record of where your money is coming from and where it’s going helps you make informed financial decisions.

- Regularly reviewing your income and expenses allows you to identify areas where you can cut back or reallocate funds to meet your financial goals.

Creating the Budget

Creating a budget is essential for managing your finances effectively. By outlining your income, expenses, and savings goals, you can take control of your financial situation and work towards achieving your objectives.

List Income, Expenses, and Savings Goals

When creating a budget, start by listing all your sources of income, such as salary, bonuses, or side hustles. Next, Artikel your monthly expenses, including rent, utilities, groceries, and any other regular payments. Finally, set clear savings goals, whether it’s for emergencies, a vacation, or retirement.

- Income: Salary, bonuses, side hustle earnings

- Expenses: Rent, utilities, groceries, transportation, entertainment

- Savings Goals: Emergency fund, vacation fund, retirement savings

Remember to allocate a portion of your income towards savings to build a financial cushion for unexpected expenses or future goals.

Budgeting Techniques

There are various budgeting techniques you can use to manage your finances effectively. The 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings. On the other hand, zero-based budgeting involves assigning every dollar a specific purpose, ensuring that your income minus expenses equals zero.

- 50/30/20 Rule: Allocate 50% to needs, 30% to wants, and 20% to savings

- Zero-Based Budgeting: Give every dollar a purpose to balance income and expenses

Adjusting the Budget

As your financial circumstances change, it’s crucial to adjust your budget accordingly. Whether you experience an increase in income, unexpected expenses, or shifting priorities, regularly review and modify your budget to reflect these changes. Stay flexible and be willing to adapt your financial plan to meet your current needs and goals.

Managing Debt and Savings

Dealing with debt and saving money are crucial components of a solid financial plan. By incorporating debt repayment strategies and setting aside funds for savings in your budget, you can work towards a more secure financial future.

Incorporating Debt Repayment and Savings

- Allocate a specific portion of your income towards paying off debts each month. Consider using the snowball or avalanche method to prioritize high-interest debts.

- Set clear goals for your savings, whether it’s for emergencies, retirement, or other financial milestones. Automate your savings contributions to make sure you stay on track.

- Adjust your budget as needed to increase debt payments or savings contributions as your financial situation improves.

Importance of Emergency Funds

- Emergency funds act as a financial safety net, providing you with funds to cover unexpected expenses like medical bills, car repairs, or job loss.

- Allocate a portion of your budget towards building an emergency fund, aiming to save at least 3-6 months’ worth of living expenses.

- Consider keeping your emergency fund in a high-yield savings account for easy access in times of need.

Reducing Debt and Increasing Savings, How to create a budget

- By following a budget, you can track your expenses and identify areas where you can cut back to free up more money for debt payments and savings.

- Consistently making on-time debt payments and contributing to your savings will help you build a strong financial foundation over time.

- As you pay off debts, reallocate those funds towards savings to accelerate your progress towards financial goals.

Monitoring and Adjusting the Budget

Regularly tracking expenses against the budget is crucial to ensure financial goals are met. By monitoring spending habits and comparing them to the budget, individuals can identify areas where they may be overspending or where adjustments need to be made.

Tracking Expenses

- Keep receipts and track expenses daily to stay on top of spending.

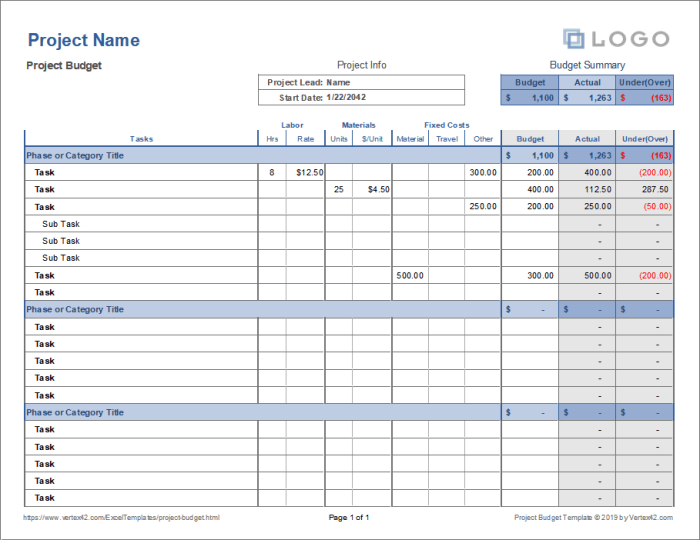

- Use budgeting apps or spreadsheets to categorize expenses and see where adjustments can be made.

- Review bank and credit card statements regularly to identify any discrepancies.

Adjusting the Budget

- If expenses exceed income, look for areas where spending can be reduced, such as dining out or entertainment.

- Consider increasing income through side hustles or freelance work to cover expenses.

- Revisit financial goals and adjust the budget accordingly to realign priorities.

Benefits of Reviewing the Budget

- Identify spending patterns and make informed decisions on where to cut back.

- Stay motivated by seeing progress towards financial goals and making necessary adjustments.

- Prevent overspending and ensure that savings are on track to meet future needs.