How to calculate net worth dives into the nitty-gritty of determining your financial standing, giving you the tools to assess your assets and liabilities like a boss. From understanding the basics to crunching the numbers, this guide will have you on your way to financial empowerment in no time.

Understanding Net Worth

Net worth is the total value of assets minus liabilities that an individual or entity holds. It is a financial metric that provides a snapshot of an individual’s current financial situation.

Calculating net worth is crucial for financial planning as it helps individuals understand their overall financial health, set financial goals, and track their progress towards achieving those goals. It also provides insights into areas where one may need to improve their financial standing.

Examples of Assets and Liabilities

Assets are items of value that contribute to a person’s net worth. Some examples of assets include:

- Real estate properties

- Investment accounts

- Retirement savings

- Personal belongings such as jewelry and vehicles

Liabilities, on the other hand, are debts or obligations that subtract from a person’s net worth. Some examples of liabilities include:

- Mortgage loans

- Car loans

- Credit card debt

- Student loans

Calculating Assets

When calculating net worth, it is essential to include a variety of assets that contribute to your overall financial value. These assets can range from real estate properties to personal belongings and investments.

Common Assets to Include

- Real Estate: Include the current market value of any properties you own, such as your primary residence, rental properties, or vacation homes.

- Investments: This category encompasses stocks, bonds, mutual funds, retirement accounts, and any other financial investments you hold.

- Personal Property: Consider the value of your vehicles, jewelry, collectibles, art pieces, and any other high-value personal belongings you own.

- Cash and Savings: Include the balance in your checking and savings accounts, as well as any cash on hand.

- Business Interests: If you own a business or have equity in a company, factor in the value of your ownership stake.

Determining Asset Values

- Real Estate: The value of real estate can be determined through appraisals, recent sales of similar properties in the area, or online valuation tools.

- Investments: For investments like stocks and bonds, use their current market value. Retirement accounts may require contacting the financial institution for accurate figures.

- Personal Property: High-value personal belongings may require appraisal from a professional to determine their worth accurately.

- Cash and Savings: The value of cash and savings is straightforward; simply include the total balance in your accounts.

- Business Interests: Valuing business interests can be complex and may require consulting with a business valuation expert.

Tips for Evaluating Assets

- Regularly Update Values: Ensure to update asset values regularly to reflect any changes in market conditions or the value of your investments.

- Be Realistic: When valuing personal property, be realistic about its worth and avoid inflating values to artificially boost your net worth.

- Seek Professional Help: For complex assets like business interests or valuable collectibles, consider seeking the expertise of professionals to ensure accurate valuation.

- Document Everything: Keep detailed records of how you arrived at the value of each asset to provide transparency and accuracy in your net worth calculations.

Evaluating Liabilities

When calculating your net worth, it’s important to consider all your liabilities, which are debts or financial obligations that you owe. These liabilities can have a significant impact on your overall net worth.

Types of Liabilities

- Credit card balances

- Student loans

- Car loans

- Mortgages

- Personal loans

Accounting for Debts

When accounting for debts in your net worth calculation, you should subtract the total amount of your liabilities from your total assets. This will give you a clearer picture of your financial standing.

Managing Liabilities

Managing your liabilities effectively is key to improving your net worth. Here are some strategies:

- Avoid taking on unnecessary debt

- Pay off high-interest debts first

- Create a budget to track your expenses and prioritize debt payments

- Consider debt consolidation to simplify your payments

Net Worth Calculation: How To Calculate Net Worth

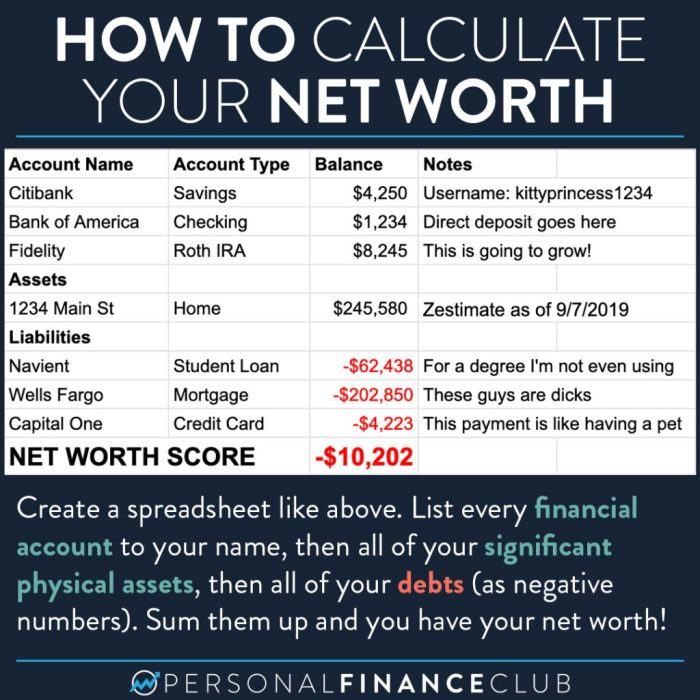

To calculate your net worth, you need to subtract your total liabilities from your total assets. This will give you a clear picture of your financial standing and help you track your progress over time.

Formula for Calculating Net Worth

Net Worth = Total Assets – Total Liabilities

- List out all your assets, including cash, investments, real estate, and personal property.

- Sum up the total value of all your assets.

- Next, make a list of all your liabilities, such as mortgages, student loans, credit card debt, and any other outstanding loans.

- Calculate the total amount of all your liabilities.

- Subtract the total liabilities from the total assets to get your net worth.

Common Mistakes to Avoid when Computing Net Worth, How to calculate net worth

- Avoid underestimating the value of your assets – make sure to include everything of value, even if it’s not easily liquidated.

- Don’t forget to consider all your liabilities – be thorough in listing out all debts and obligations.

- Avoid inaccuracies in your calculations – double-check your figures to ensure accuracy.

- Don’t ignore changes in market value – update the value of assets like investments and real estate regularly.