Real estate investment strategies are the key to unlocking success in the property market. From buy and hold to fix and flip, these tactics are essential for seasoned investors looking to make a mark. Get ready to dive into the world of real estate investing like never before.

Real Estate Investment Strategies

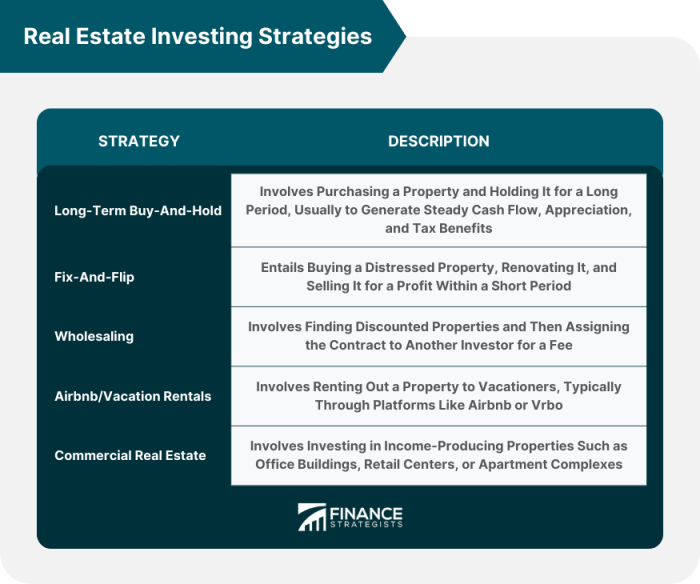

Real estate investment strategies refer to the specific plans and approaches that investors use to make money in the real estate market. These strategies help investors maximize their returns, minimize risks, and achieve their financial goals.

Types of Real Estate Investment Strategies

- Buy and Hold: Investors purchase properties with the intention of holding onto them for an extended period, allowing the properties to appreciate in value over time.

- Fix and Flip: Investors buy properties that need repairs or renovations, improve them, and then sell them quickly for a profit.

- Rental Properties: Investors buy properties to rent out to tenants, generating a steady income stream through rental payments.

- REITs (Real Estate Investment Trusts): Investors can invest in publicly traded REITs, which pool money to invest in various real estate assets, providing diversification and passive income.

The Importance of a Well-Defined Investment Strategy

Having a well-defined investment strategy in real estate is crucial for success. It helps investors set clear goals, make informed decisions, and stay focused on their objectives. A solid strategy also allows investors to adapt to market changes and mitigate risks effectively.

Examples of Successful Real Estate Investment Strategies

- Warren Buffett’s Value Investing Approach: Buffett focuses on buying undervalued properties with strong growth potential, holding onto them for the long term.

- Barbara Corcoran’s Rental Property Portfolio: Corcoran built a successful real estate empire by investing in rental properties in high-demand areas, generating consistent cash flow.

- Robert Kiyosaki’s Cash Flow Quadrant Strategy: Kiyosaki emphasizes the importance of generating passive income through real estate investments to achieve financial freedom.

Market Research and Analysis

Market research is crucial before diving into any real estate investment strategy. It helps investors understand the current market conditions, trends, and potential risks involved in a particular area. Without proper research, investors may make uninformed decisions that could lead to financial losses.Market analysis plays a significant role in selecting the most suitable real estate investment strategy. By analyzing market trends, property values, rental rates, and potential returns, investors can determine which strategy aligns best with their financial goals and risk tolerance.

This analysis allows investors to identify opportunities for growth and assess the potential profitability of different investment options.

Methods for Analyzing Market Trends

- Utilize online platforms and real estate databases to track market trends and property values.

- Consult with local real estate agents and experts to gain insights into the current market conditions.

- Analyze historical data and compare it with current market trends to predict future growth potential.

Role of Demographics and Economic Factors

- Demographics such as population growth, income levels, and age distribution can influence the demand for real estate in a particular area.

- Economic factors like job growth, interest rates, and GDP can impact property values and rental rates, shaping investment strategies accordingly.

- Understanding the demographics and economic landscape of an area can help investors make informed decisions about where and when to invest in real estate.

Risk Management

Risk management is a crucial aspect of real estate investments as it helps investors protect their assets and maximize returns. By identifying and mitigating potential risks, investors can minimize financial losses and ensure the long-term success of their investment portfolios.

Common Risks in Real Estate Investments

- Market Risk: Fluctuations in real estate market conditions can impact property values and rental income.

- Interest Rate Risk: Changes in interest rates can affect mortgage payments and financing costs.

- Liquidity Risk: Difficulty in selling properties quickly can lead to cash flow problems.

- Operational Risk: Issues with property management or maintenance can result in additional expenses.

Strategies for Mitigating Risks

- Diversification: Investing in different types of properties and locations can help spread risk.

- Due Diligence: Thoroughly researching properties, markets, and potential tenants can reduce risks associated with investment decisions.

- Insurance: Obtaining appropriate insurance coverage can protect against unforeseen events like natural disasters or liability claims.

- Reserve Funds: Setting aside funds for property maintenance, vacancies, and unexpected expenses can help mitigate financial risks.

Risk Management Techniques in Successful Real Estate Portfolios

- Regular Monitoring: Keeping track of market trends, property performance, and financial metrics can help investors identify and address risks proactively.

- Professional Management: Hiring experienced property managers or real estate professionals can ensure efficient operations and risk mitigation.

- Stress Testing: Conducting stress tests to analyze how different scenarios may impact investment returns can help investors prepare for potential risks.

- Exit Strategies: Developing exit plans for each investment can help investors respond effectively to changing market conditions and mitigate risks associated with property disposal.

Financing Options

When it comes to real estate investments, having the right financing in place is crucial. There are several financing options available to investors, each with its own set of advantages and disadvantages. Let’s take a closer look at some of the most common options and how they can impact your overall investment strategy.

Traditional Mortgages, Real estate investment strategies

Traditional mortgages are one of the most popular financing options for real estate investments. They typically offer lower interest rates and longer repayment terms compared to other types of loans. However, qualifying for a traditional mortgage can be challenging, especially for new investors with limited credit history or income.

Hard Money Loans

Hard money loans are short-term, high-interest loans that are typically used by investors who need quick financing or have difficulty qualifying for traditional mortgages. While hard money loans can be easier to obtain, they often come with higher interest rates and fees, making them a more expensive option in the long run.

Private Money Lenders

Private money lenders are individuals or private companies that provide financing for real estate investments. Working with private lenders can offer more flexibility and faster approval times compared to traditional lenders. However, private money lenders may charge higher interest rates and require additional collateral to secure the loan.

Impact on Investment Strategy

The financing option you choose can significantly impact your overall investment strategy. For example, if you opt for a traditional mortgage, you may have lower monthly payments but a longer repayment term. On the other hand, hard money loans may allow you to secure financing quickly but at a higher cost. It’s essential to consider how each financing option aligns with your investment goals and risk tolerance.

Tips for Securing Financing

- Improve your credit score to increase your chances of qualifying for a traditional mortgage.

- Build relationships with private money lenders to access more flexible financing options.

- Consider working with a financial advisor to explore all available financing options and choose the best fit for your investment strategy.