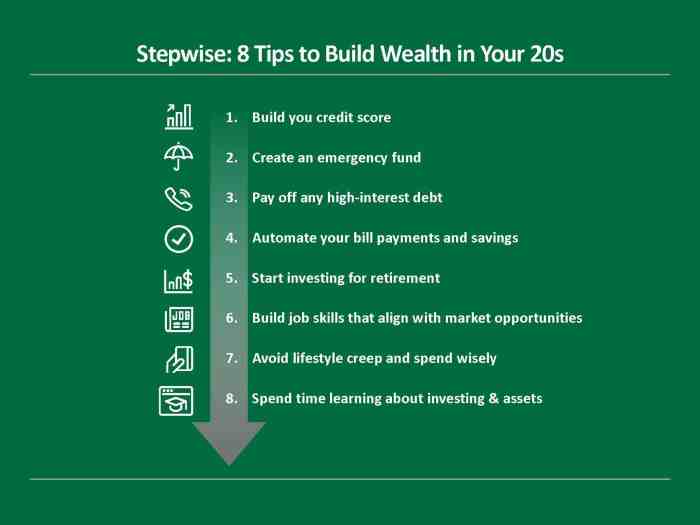

How to build wealth in your 20s sets the stage for financial success early on, diving into strategies and tips for young adults to secure their financial future.

From setting financial goals to exploring investment options and increasing income streams, this guide covers essential steps to achieve financial stability and growth in your twenties.

Setting Financial Goals: How To Build Wealth In Your 20s

Setting specific financial goals in your 20s is crucial for laying a strong foundation for building wealth. By having clear objectives, you can stay focused, motivated, and track your progress effectively over time.

Short-Term Financial Goals

- Creating an emergency fund to cover unexpected expenses

- Paying off high-interest debt like credit cards

- Setting a budget and sticking to it each month

Long-Term Financial Goals

- Saving for a down payment on a house or investment property

- Investing in a retirement account like a 401(k) or IRA

- Starting a side business or investing in stocks

Setting financial goals helps in building wealth over time by providing a roadmap for your financial journey. It allows you to prioritize your spending, save and invest wisely, and make informed decisions that align with your long-term objectives. By regularly reviewing and adjusting your goals, you can ensure that you are on track to achieve financial success in the future.

Budgeting and Saving

Understanding how to budget and save money is crucial for young adults looking to build wealth in their 20s. By creating a budget and sticking to it, individuals can effectively manage their finances and work towards achieving their financial goals.

Creating a Budget

Creating a budget involves listing all sources of income and expenses to determine how much money is coming in and going out each month. Here are some practical tips to help you create a budget:

- Track your expenses: Keep a record of your spending to identify where your money is going.

- Set financial goals: Determine what you want to achieve financially and allocate funds accordingly.

- Use budgeting apps: Utilize apps to track your expenses and stay within your budget limits.

Sticking to Your Budget

Sticking to your budget is essential for long-term financial growth. Here are some strategies to help you stay on track:

- Avoid impulse spending: Think twice before making impulse purchases and stick to your budgeted expenses.

- Review your budget regularly: Make adjustments as needed to ensure your budget aligns with your financial goals.

- Automate your savings: Set up automatic transfers to your savings account each month to pay yourself first.

Paying yourself first means prioritizing saving money before spending on other expenses, helping you build wealth over time.

Investing for the Future

Investing in your 20s can set you up for financial success in the long run. It’s essential to understand different investment options and strategies to make informed decisions for your future financial well-being.

Stocks

- Stocks represent ownership in a company and can offer high returns over time.

- Investing in individual stocks requires research and monitoring, but you can also opt for exchange-traded funds (ETFs) for diversification.

- Stocks are considered riskier investments but can provide significant growth potential.

Bonds

- Bonds are debt securities issued by governments or corporations, offering a fixed interest rate over a specified period.

- They are generally considered safer investments than stocks, providing a steady income stream.

- Bonds can add stability and income to your investment portfolio.

Real Estate, How to build wealth in your 20s

- Investing in real estate can provide both rental income and potential appreciation in property value.

- You can invest in rental properties, real estate investment trusts (REITs), or real estate crowdfunding platforms.

- Real estate can be a tangible asset that diversifies your investment portfolio.

Retirement Accounts

- 401(k), IRA, and Roth IRA are common retirement accounts that offer tax advantages for long-term savings.

- Contributing to these accounts early in your career can help you build a substantial nest egg for retirement.

- Take advantage of employer matching contributions in 401(k) plans to maximize your savings.

Risk Management and Diversification

- It’s crucial to diversify your investment portfolio to reduce risk and increase potential returns.

- Asset allocation across different asset classes can help you weather market volatility.

- Consider your risk tolerance, investment goals, and time horizon when creating a well-balanced portfolio.

Increasing Income Streams

In your 20s, it’s crucial to focus on increasing your income streams to build wealth and financial stability for the future. By generating multiple sources of income, you can diversify your earnings and create more opportunities for growth and success.

Starting a Side Hustle or Freelance Work

One way to boost your earnings is by starting a side hustle or freelance work in addition to your main job. This can be anything from offering freelance services like graphic design, writing, or photography, to starting a small online business selling products or services.

- Consider your skills and interests to determine what type of side hustle would be the most profitable and enjoyable for you.

- Utilize online platforms like Upwork, Fiverr, or Etsy to promote your services or products and reach a wider audience.

- Allocate dedicated time each week to work on your side hustle and track your progress to ensure steady growth.

Creating Passive Income Streams

Passive income is money earned with minimal effort or active involvement on your part. This type of income can provide a steady flow of money even when you’re not actively working, allowing you to build wealth over time.

- Invest in dividend-paying stocks or real estate properties to generate passive income through regular dividends or rental payments.

- Create digital products like e-books, online courses, or stock photography to earn passive income through royalties or sales commissions.

- Explore affiliate marketing programs or create a blog or YouTube channel to earn passive income through advertising revenue or affiliate commissions.