How to trade forex like a professional? Buckle up as we dive into the world of forex trading, unraveling the secrets to trading like a pro with finesse and expertise.

From understanding the basics to developing winning strategies, this guide will equip you with the skills needed to navigate the forex market like a seasoned trader.

Introduction to Forex Trading: How To Trade Forex Like A Professional

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies in the global market. It is the largest and most liquid financial market in the world, with trillions of dollars traded daily. Forex trading plays a crucial role in facilitating international trade and investment by allowing businesses to convert one currency into another.

Basic Concepts of Forex Trading, How to trade forex like a professional

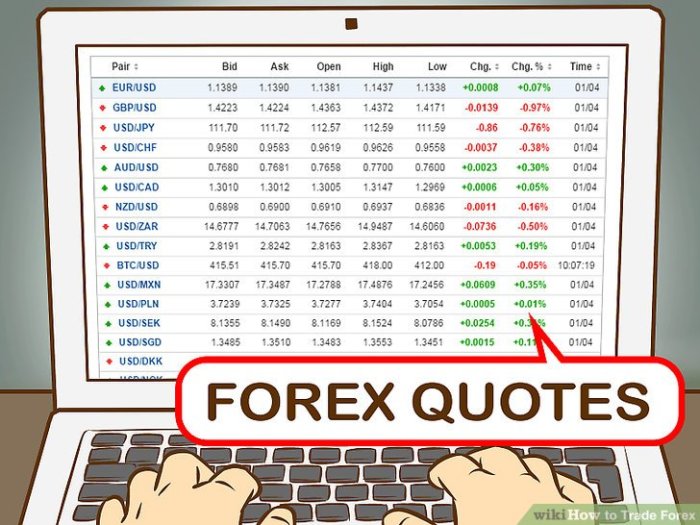

- Currency Pairs: In forex trading, currencies are always traded in pairs, such as EUR/USD or GBP/JPY. Each pair represents the exchange rate between the two currencies.

- Pips: A pip is the smallest price move that a given exchange rate can make. Most currency pairs are quoted to four decimal places, so a one-pip move would be the equivalent of 0.0001.

- Leverage: Forex trading often involves the use of leverage, which allows traders to control a large position with a relatively small amount of capital. While leverage can amplify profits, it also increases the risk of significant losses.

Key Differences Between Forex Trading and Stock Trading

- 24-Hour Market: Unlike the stock market, which has set trading hours, the forex market is open 24 hours a day, five days a week, allowing for around-the-clock trading.

- Liquidity: The forex market is highly liquid, meaning that traders can enter and exit positions quickly without significant price movements. This liquidity is due to the large volume of trades conducted daily.

- Market Structure: While the stock market consists of centralized exchanges, the forex market is decentralized, with trading taking place over-the-counter. This decentralized structure allows for greater flexibility and accessibility for traders.

Essential Skills for Professional Forex Trading

To trade forex like a pro, you need to master some essential skills that can make or break your success in the market. These skills include risk management, technical analysis, and emotional discipline. Let’s dive into each of these critical aspects.

Risk Management in Forex Trading

Risk management is crucial in forex trading to protect your capital and minimize losses. It involves setting stop-loss orders, using proper position sizing, and diversifying your trades. By managing risk effectively, you can survive in the market long enough to capitalize on profitable opportunities.

- Set stop-loss orders to limit potential losses and protect your capital.

- Use proper position sizing to ensure that no single trade can wipe out your account.

- Diversify your trades across different currency pairs to spread risk and avoid overexposure.

Role of Technical Analysis in Trading Decisions

Technical analysis involves studying historical price charts and using various indicators to predict future price movements. It helps traders identify trends, support and resistance levels, and potential entry and exit points. By incorporating technical analysis into your trading strategy, you can make more informed decisions based on market data.

- Identify trends by analyzing price charts and using indicators like moving averages and RSI.

- Utilize support and resistance levels to determine potential entry and exit points for trades.

- Combine technical analysis with fundamental analysis for a comprehensive view of the market.

Significance of Emotional Discipline in Forex Trading

Emotional discipline is the ability to control your emotions and stick to your trading plan, even in the face of market volatility and uncertainty. It helps traders avoid impulsive decisions driven by fear or greed, which can lead to costly mistakes. By maintaining emotional discipline, you can trade with a clear mind and focus on long-term success.

- Follow a trading plan and avoid deviating from it based on emotions or impulses.

- Practice patience and avoid chasing trades or trying to “get even” after a loss.

- Manage stress through proper risk management and self-care to maintain a healthy mindset for trading.

Developing a Trading Strategy

When it comes to forex trading, having a solid strategy is key to success. A personalized trading strategy helps you navigate the unpredictable forex market and make informed decisions.

Types of Trading Strategies

- Scalping: A strategy that involves making numerous small trades to capitalize on small price movements.

- Day Trading: Buying and selling financial instruments within the same trading day to take advantage of intraday price movements.

- Swing Trading: Holding positions for several days to weeks to catch larger price movements.

Indicators and Tools for Developing a Trading Strategy

- Moving Averages: Used to identify trends and potential entry/exit points.

- Relative Strength Index (RSI): Measures the speed and change of price movements to determine overbought or oversold conditions.

- Bollinger Bands: Helps identify volatility and potential reversal points.

- Fibonacci Retracement: Used to identify potential support and resistance levels based on the Fibonacci sequence.

Executing Trades Like a Professional

When it comes to trading forex like a professional, executing trades plays a crucial role in determining your success in the market. In this section, we will discuss how to use fundamental analysis to identify trading opportunities, the process of setting up entry and exit points for trades, and the importance of backtesting trading strategies before implementation.

Using Fundamental Analysis

Fundamental analysis involves evaluating various economic and geopolitical factors that can impact the value of a currency. By keeping track of important indicators such as interest rates, GDP growth, employment data, and geopolitical events, traders can identify potential trading opportunities. It is essential to stay informed about global economic trends and news that can influence currency prices.

- Pay attention to economic calendars and news releases to stay updated on important events.

- Consider the impact of central bank decisions on currency values.

- Use tools like Bloomberg, Reuters, and economic calendars to gather relevant information.

Setting Up Entry and Exit Points

Setting up entry and exit points is crucial for managing risk and maximizing profits in forex trading. Traders can use technical analysis tools such as support and resistance levels, moving averages, and Fibonacci retracement levels to determine optimal entry and exit points for trades. It is important to establish clear stop-loss and take-profit levels to control risk and lock in profits.

- Identify key support and resistance levels to determine entry and exit points.

- Use technical indicators to confirm trade signals and validate entry and exit points.

- Implement proper risk management strategies to protect your capital.

The Importance of Backtesting

Backtesting involves testing a trading strategy using historical data to evaluate its effectiveness before implementing it in live trading. By backtesting your trading strategies, you can identify potential flaws and weaknesses that need to be addressed. This process helps traders refine their strategies and improve their overall performance in the market.

- Use backtesting software or platforms to simulate trades and analyze results.

- Adjust parameters and variables based on backtesting results to improve strategy performance.

- Continuously evaluate and refine your trading strategies through backtesting to stay ahead in the market.

Continuous Learning and Improvement

Continuous learning and improvement are essential for professional forex traders to stay ahead in the market. By staying updated on market trends, journaling trades, analyzing performance, and adapting to changing market conditions, traders can improve their skills over time.

Resources for Staying Updated

- Subscribe to financial news websites like Bloomberg, Reuters, and CNBC for the latest updates on market trends.

- Follow influential traders and analysts on social media platforms like Twitter for real-time insights and analysis.

- Attend webinars, seminars, and workshops conducted by industry experts to enhance your knowledge and skills.

Importance of Journaling Trades

- Keep a trading journal to track your trades, including entry and exit points, reasons for the trade, and emotions involved.

- Reviewing your trading journal can help you identify patterns, strengths, and weaknesses in your trading strategy.

- By analyzing your performance, you can learn from past mistakes and make improvements to your trading approach.

Adapting to Changing Market Conditions

- Stay flexible and open-minded to adjust your trading strategy based on evolving market conditions.

- Monitor economic indicators, geopolitical events, and central bank announcements that can impact currency movements.

- Practice risk management techniques to protect your capital during volatile market periods.