Budgeting for Entrepreneurs sets the stage for financial success, outlining key strategies and pitfalls to avoid in the entrepreneurial world. Get ready to dive into the world of budgeting like a boss!

Importance of Budgeting for Entrepreneurs

Budgeting is an essential aspect of running a successful business as an entrepreneur. It allows you to plan and allocate your financial resources effectively, ensuring that you have enough funds to cover your expenses and invest in growth opportunities.

Financial Planning

Creating a budget helps entrepreneurs set clear financial goals and track their progress towards achieving them. By outlining expected revenues and expenses, entrepreneurs can make informed decisions about where to allocate their resources.

Risk Management

Effective budgeting enables entrepreneurs to identify potential financial risks and develop strategies to mitigate them. By having a clear understanding of their financial situation, entrepreneurs can navigate challenges and uncertainties more effectively.

Resource Optimization

With a well-planned budget, entrepreneurs can optimize their resources and avoid unnecessary expenses. By prioritizing investments that align with their business goals, entrepreneurs can maximize their returns and drive sustainable growth.

Components of a Comprehensive Budgeting Plan

Effective budgeting is crucial for entrepreneurs to manage their finances and achieve their business goals. A comprehensive budgeting plan should include key components to ensure the business’s financial health and success.

Key Components of a Budgeting Plan

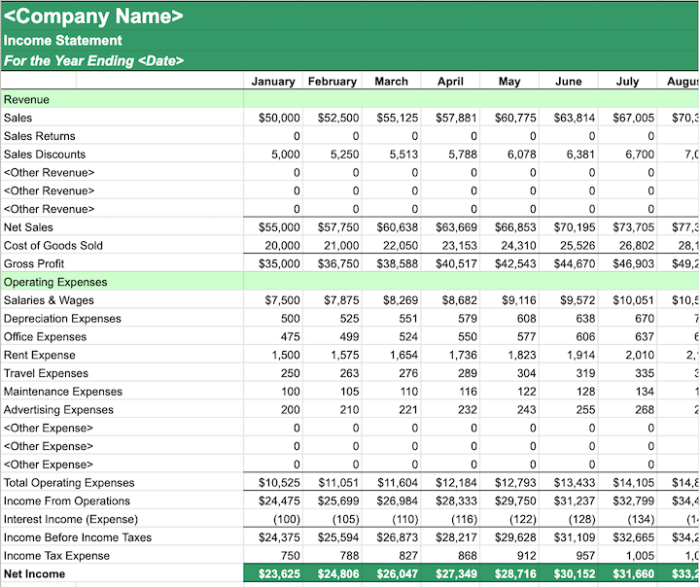

- Revenue Projections: Forecasting the income your business expects to generate is essential for budget planning. This includes sales projections, pricing strategies, and anticipated revenue streams.

- Expense Estimates: Identifying and estimating all potential expenses is crucial to avoid financial surprises. This includes fixed costs (rent, utilities) and variable costs (inventory, marketing).

- Cash Flow Management: Monitoring cash flow is vital for maintaining liquidity and ensuring the business can meet its financial obligations. This involves tracking incoming and outgoing cash to avoid cash flow shortages.

- Contingency Planning: Including a buffer for unexpected expenses or emergencies in the budget is important to handle unforeseen circumstances without jeopardizing the business’s operations.

The Importance of Forecasting in Budget Planning

Forecasting plays a significant role in budget planning as it helps entrepreneurs make informed decisions based on anticipated future outcomes. By predicting revenues and expenses, entrepreneurs can set realistic financial goals, allocate resources effectively, and identify potential risks or opportunities.

Allocating Resources Effectively within a Budget

Entrepreneurs must prioritize resource allocation based on the business’s goals and objectives. By aligning budget allocations with strategic priorities, entrepreneurs can maximize the impact of their resources and ensure that funds are used efficiently. This involves evaluating the return on investment for each expense and adjusting allocations to optimize financial performance.

Strategies for Effective Budgeting: Budgeting For Entrepreneurs

Effective budgeting is crucial for the success of any entrepreneur. It involves creating a realistic budget, monitoring it regularly, and making adjustments as needed to ensure financial stability and growth. Here are some strategies that entrepreneurs can use to create and maintain an effective budget:

Creating a Realistic Budget

- Start by setting clear financial goals and objectives for your business.

- Estimate your income and expenses accurately, taking into account both fixed and variable costs.

- Consider any seasonal fluctuations in revenue and expenses to create a more accurate budget.

- Include a buffer for unexpected expenses or emergencies to avoid financial strain.

Monitoring and Adjusting the Budget, Budgeting for Entrepreneurs

- Regularly track your actual income and expenses against your budgeted amounts.

- Identify any discrepancies or areas where you are overspending and make necessary adjustments.

- Review your budget periodically and make changes based on new business developments or financial goals.

- Use financial software or tools to streamline the budgeting process and identify areas for improvement.

Traditional vs Innovative Approaches

- Traditional budgeting methods involve creating a detailed budget based on historical data and projections.

- Innovative approaches, such as zero-based budgeting, focus on justifying every expense from scratch to ensure efficiency.

- Newer tools like AI-powered budgeting software offer real-time insights and forecasting capabilities for better decision-making.

- Combining traditional methods with innovative approaches can provide a more comprehensive and adaptable budgeting strategy.

Common Budgeting Mistakes to Avoid

Budgeting is crucial for the success of any entrepreneur, but there are common mistakes that can derail your financial planning efforts. By being aware of these pitfalls and taking proactive steps to avoid them, you can ensure that you stay within budget constraints and make informed financial decisions.

Failing to Account for Unexpected Expenses

One of the most common budgeting mistakes entrepreneurs make is failing to anticipate unexpected expenses. Whether it’s a sudden equipment breakdown, a legal issue, or a drop in sales, not having a contingency fund can quickly lead to financial strain. To avoid this, make sure to allocate a portion of your budget to cover unforeseen costs.

Overestimating Revenue

Another mistake entrepreneurs often make is overestimating their revenue projections. While it’s important to set ambitious goals, it’s crucial to be realistic about your sales forecasts. Overestimating revenue can lead to overspending, reliance on loans, or even bankruptcy. Take a conservative approach to revenue projections to avoid this pitfall.

Ignoring Seasonal Fluctuations

Many entrepreneurs overlook the impact of seasonal fluctuations on their budgeting plans. Certain times of the year may bring in more revenue, while others may see a slowdown in sales. Failing to account for these fluctuations can result in cash flow problems and financial instability. Make sure to adjust your budget accordingly to accommodate seasonal changes.

Not Tracking Expenses Regularly

Lastly, a common budgeting mistake is not tracking expenses regularly. Without a clear picture of where your money is going, it’s easy to overspend and lose control of your finances. Implement a system to track expenses consistently, whether it’s through software, spreadsheets, or apps. This will help you stay on top of your spending and make necessary adjustments to stay within budget.