Get ready to dive into the world of Best budgeting methods with this comprehensive guide. From zero-based budgeting to the envelope system, we’ll explore all the tricks and tips to help you master your finances like a pro.

In the following sections, we’ll break down the different types of budgeting methods, the importance of setting financial goals, tracking expenses effectively, and creating a solid budget that works for you. Let’s get started!

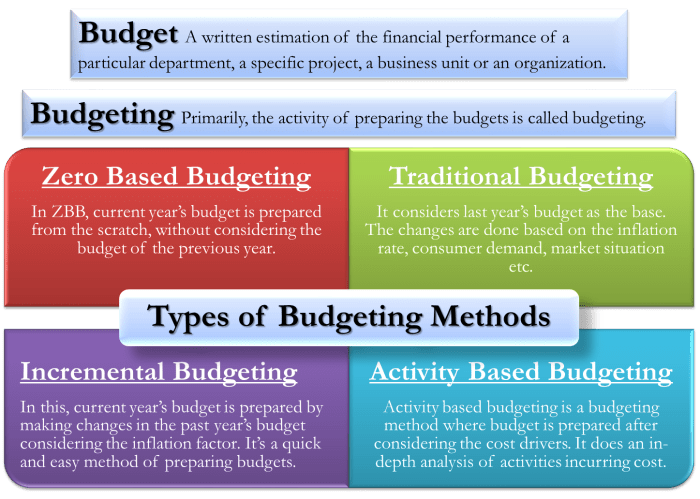

Types of Budgeting Methods

Budgeting methods are crucial in managing your finances effectively. Here are some common types of budgeting methods along with their pros and cons.

Zero-Based Budgeting

Zero-based budgeting is a method where every dollar of income is assigned a specific purpose, ensuring that all income is allocated and nothing is left unaccounted for. This method requires you to create a new budget from scratch each month, starting at zero.

- Pros:

- Ensures every dollar is allocated

- Encourages intentional spending

- Cons:

- Time-consuming to create a budget each month

- May be challenging to stick to the budget strictly

50/30/20 Budgeting

The 50/30/20 budgeting method involves allocating 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment. This framework helps in balancing your spending and saving priorities.

- Pros:

- Provides a clear guideline on how to divide your income

- Allows for flexibility in spending on wants

- Cons:

- May not work for everyone’s financial situation

- Does not address specific financial goals

Envelope System

The envelope system involves dividing your cash into different envelopes labeled for specific spending categories. Once an envelope is empty, you cannot spend more in that category until the next budgeting period.

- Pros:

- Helps control spending in specific categories

- Provides a visual representation of your budget

- Cons:

- Requires discipline to stick to the cash-only system

- May be inconvenient for online or card transactions

Setting Financial Goals

Setting financial goals is a crucial step in effective budgeting. By defining clear objectives, individuals can focus their efforts and resources towards achieving specific milestones. Here are some tips on how to set realistic and achievable financial goals:

Importance of Setting Financial Goals

- Setting financial goals provides direction and purpose to your budgeting efforts.

- It helps you prioritize your spending and savings, ensuring that you allocate resources to what truly matters to you.

- Having clear goals motivates you to stay disciplined and committed to your budget, even when faced with temptations to overspend.

Tips for Setting Realistic Financial Goals

- Start by identifying your short-term, medium-term, and long-term financial objectives.

- Ensure that your goals are specific, measurable, achievable, relevant, and time-bound (SMART).

- Consider factors like your income, expenses, debt obligations, and savings capacity when setting your goals.

How Financial Goals Help in Choosing a Budgeting Method

- Once you have clear financial goals, you can align them with the budgeting method that best suits your objectives.

- For example, if your goal is to save for a down payment on a house in the next five years, you might opt for a goal-based budgeting approach.

- On the other hand, if you want to reduce your overall spending and increase your savings rate, a zero-based budgeting method could be more suitable.

Tracking Expenses

Tracking expenses is a crucial aspect of budgeting that allows individuals to monitor where their money is going and make informed decisions about their finances. By keeping track of expenses, one can identify spending patterns, cut unnecessary costs, and stay within budget.

Different Tools and Methods for Tracking Expenses

- Pen and Paper: The traditional method of jotting down expenses in a notebook can be effective for those who prefer a hands-on approach.

- Spreadsheets: Using software like Microsoft Excel or Google Sheets can help organize expenses and create detailed budget reports.

- Expense Tracking Apps: There are various apps available, such as Mint, YNAB, and PocketGuard, that automatically categorize expenses and provide insights into spending habits.

- Receipts and Invoices: Keeping physical or digital receipts can also aid in tracking expenses and maintaining accurate records.

Strategies for Analyzing and Categorizing Expenses

- Monthly Reviews: Regularly reviewing expenses at the end of each month can help identify areas where spending can be reduced or adjusted.

- Categorization: Grouping expenses into categories like groceries, utilities, entertainment, and transportation can provide a clearer picture of where money is being allocated.

- Comparison to Income: Calculating the percentage of income spent on essential expenses versus discretionary spending can help prioritize and make necessary adjustments.

- Setting Limits: Establishing spending limits for each category can prevent overspending and ensure that funds are allocated appropriately.

Creating a Budget

Creating a budget from scratch is a crucial step in managing your finances effectively. It involves carefully outlining your income and expenses to ensure you are living within your means and working towards your financial goals.

Importance of Including Fixed and Variable Expenses

- Fixed expenses are costs that remain constant each month, such as rent or mortgage payments, car payments, and insurance premiums.

- Variable expenses, on the other hand, are costs that can fluctuate, like groceries, entertainment, and dining out.

- It is essential to include both fixed and variable expenses in your budget to get a comprehensive view of your financial situation and make informed decisions.

Tips on Adjusting a Budget as Circumstances Change

- Regularly review your budget to ensure it aligns with your current financial goals and priorities.

- If your income or expenses change, make the necessary adjustments to your budget to accommodate these changes.

- Consider reallocating funds from one category to another if needed, but always prioritize your essential expenses first.

- Track your spending regularly to identify areas where you can cut back or save more, helping you stay on track with your budget.