Picture this: budget spreadsheet templates, the ultimate tool for financial organization and success. Get ready to dive into a world where planning meets precision, where budgeting becomes a breeze.

Let’s explore the different types of templates, how to use them effectively, and the benefits they bring to the table. Get ready to revolutionize your budgeting game!

Types of Budget Spreadsheet Templates

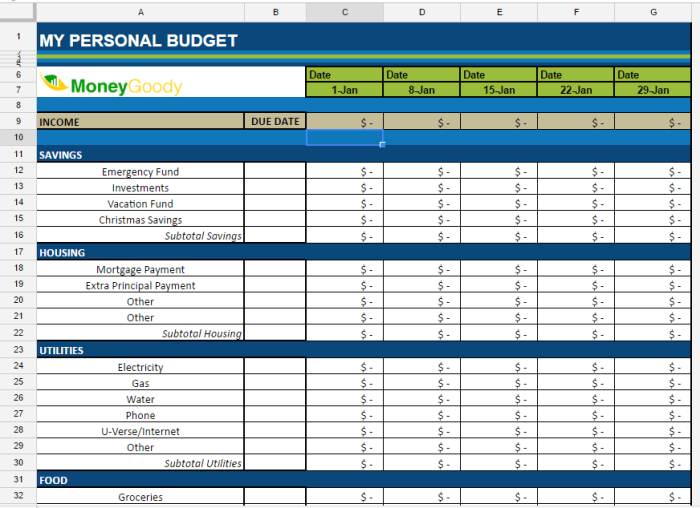

When it comes to budgeting, having the right tool can make all the difference. Here are some examples of different types of budget spreadsheet templates that can help you stay on top of your finances:

1. Monthly Budget Template

- A classic template that helps you track your income and expenses on a monthly basis.

- Includes categories for different expenses such as rent, groceries, utilities, and more.

- Allows you to set budget goals and monitor your spending throughout the month.

2. Yearly Budget Template

- Provides a broader view of your finances over the course of a year.

- Helps you plan for big expenses like vacations, holidays, and major purchases.

- Allows you to see trends in your spending and adjust your budget accordingly.

3. Debt Payoff Tracker Template

- Specifically designed to help you track and pay off your debts more efficiently.

- Includes features like debt snowball or debt avalanche methods to prioritize debt payments.

- Shows you the progress you’re making towards becoming debt-free.

4. Savings Goal Template

- Focuses on setting and achieving specific savings goals, such as a down payment for a house or a dream vacation.

- Allows you to track your progress and adjust your savings strategies as needed.

- Motivates you to stay on track towards reaching your financial goals.

How to Use Budget Spreadsheet Templates

Using budget spreadsheet templates can be a great way to track your expenses and manage your finances effectively. Here are some steps to help you make the most out of these templates:

Set Up Your Budget Categories

- Create categories for your expenses such as rent, groceries, utilities, entertainment, etc.

- Allocate a specific budget amount for each category based on your income and spending habits.

Track Your Expenses Regularly

- Enter all your expenses in the designated categories on a daily or weekly basis.

- Make sure to update your spreadsheet regularly to have an accurate overview of your spending.

Monitor Your Budget

- Compare your actual spending to your budgeted amounts to see if you are staying on track.

- Adjust your budget categories and amounts as needed to reflect any changes in your financial situation.

Customize Your Template

- Personalize your budget spreadsheet by adding or removing categories to better suit your individual needs.

- Modify the formatting, colors, and layout to make it visually appealing and easy to read.

Common Mistakes to Avoid

- Avoid forgetting to input all your expenses, as this can lead to an inaccurate representation of your finances.

- Avoid setting unrealistic budget amounts that do not align with your income, which can make it difficult to stick to your budget.

Customizing Budget Spreadsheet Templates

When it comes to customizing budget spreadsheet templates, the possibilities are endless. Whether you’re looking to personalize a budget spreadsheet for personal finances or tailor one for business use, there are a variety of ways to make it work for you.

Adding Categories and Subcategories

- One way to customize a budget spreadsheet template is by adding specific categories and subcategories that align with your spending habits or business expenses.

- For personal use, you can include categories such as groceries, entertainment, or transportation, while for business use, you might want to include categories like marketing, utilities, or office supplies.

- By breaking down expenses into detailed categories, you can get a clearer picture of where your money is going and make more informed financial decisions.

Customizing Formulas and Functions

- Another way to tailor a budget spreadsheet template is by customizing formulas and functions to calculate totals, percentages, or projections based on your specific needs.

- For personal budgets, you might want to add formulas to track savings goals or debt repayment progress, while for business budgets, you could include formulas to calculate profit margins or return on investment.

- Customizing formulas and functions can help automate calculations and provide valuable insights into your financial situation.

Visual Enhancements and Conditional Formatting

- To enhance the visual appeal and usability of a budget spreadsheet template, you can add color-coded categories, charts, or graphs to visualize your financial data.

- Conditional formatting can also be used to highlight important information, such as overspending in a specific category or reaching a savings goal.

- Visual enhancements can make it easier to interpret data quickly and identify areas where adjustments may be needed.

Benefits of Using Budget Spreadsheet Templates

Budget spreadsheet templates offer numerous advantages for financial planning. They provide a structured framework for organizing income, expenses, and savings, making it easier to track and manage finances effectively. By utilizing these templates, individuals and businesses can gain valuable insights into their financial situation and make informed decisions to achieve their financial goals.

Efficient Expense and Income Tracking

- One of the key benefits of using budget spreadsheet templates is the ability to track expenses and income in a systematic manner. With designated categories and sections for different types of expenses, individuals can easily monitor where their money is going and identify areas where they can cut back or save.

- By inputting income sources and expenses into the spreadsheet regularly, users can gain a clear overview of their cash flow and make adjustments as needed to ensure they stay within budget.

Improved Financial Planning

- With budget spreadsheet templates, individuals and businesses can create detailed financial plans that align with their goals and priorities. By setting specific budget targets for different categories, such as groceries, utilities, and entertainment, users can establish a roadmap for achieving financial stability.

- These templates also allow for the incorporation of savings goals, debt repayment plans, and emergency funds, enabling users to plan for both short-term and long-term financial needs.

Real-Life Examples

- For example, a young professional using a budget spreadsheet template was able to track her monthly expenses and identify unnecessary spending habits. By making adjustments to her budget based on the insights gained from the template, she was able to increase her savings and work towards purchasing her first home.

- Similarly, a small business owner used a budget spreadsheet template to monitor cash flow and identify opportunities for cost savings. By analyzing the data within the template, the business owner was able to streamline operations and improve profitability.