Get ready to dive into the world of Budgeting techniques like never before. This guide is your ticket to understanding the ins and outs of managing your finances with style and precision.

From traditional methods to cutting-edge technology, we’ve got you covered with everything you need to know about effective budgeting techniques.

Budgeting Techniques Overview

Budgeting techniques are essential tools in financial management that help individuals and businesses plan, track, and control their spending. By utilizing these techniques, individuals and businesses can set financial goals, allocate resources effectively, and achieve financial stability.

Primary Goals of Budgeting Techniques

- Establishing financial goals: Budgeting techniques help set clear objectives for saving, investing, and spending.

- Monitoring cash flow: By tracking income and expenses, individuals and businesses can ensure they are staying within their budget.

- Identifying areas for improvement: Budgeting techniques highlight areas where adjustments can be made to optimize financial resources.

How Budgeting Techniques Help Achieve Financial Stability

- Preventing overspending: Budgeting techniques enable individuals and businesses to control their expenses and avoid going into debt.

- Building savings: By allocating funds for savings through budgeting, individuals and businesses can create an emergency fund or save for future goals.

- Planning for the future: Budgeting techniques allow for long-term financial planning, such as retirement savings or investments.

Popular Budgeting Techniques

- The 50/30/20 rule: Allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-based budgeting: Assigning every dollar of income a specific purpose, leaving no money unaccounted for.

- Variance analysis: Comparing actual expenses to budgeted amounts to identify discrepancies and make adjustments.

Traditional Budgeting Methods

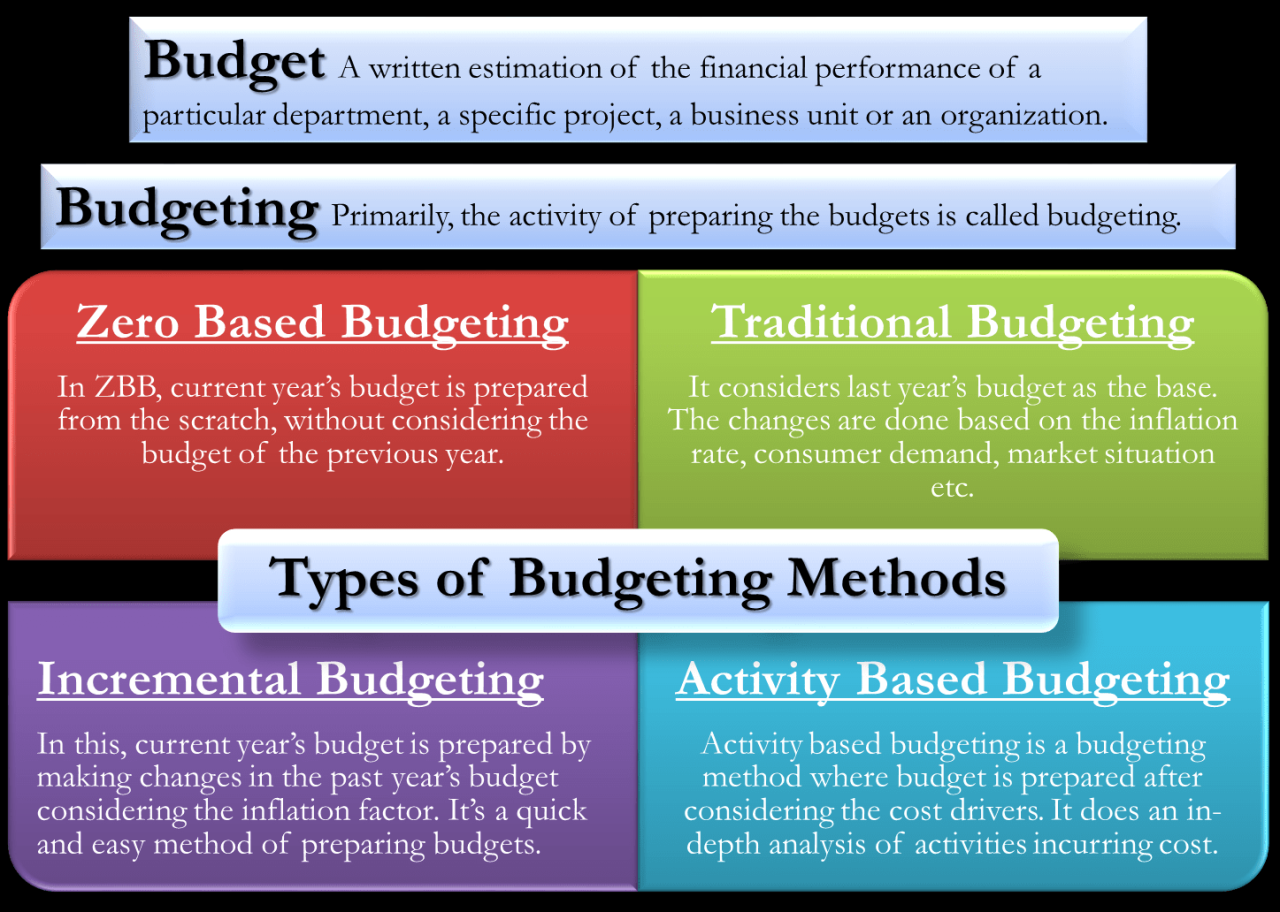

Traditional budgeting methods have been widely used by organizations to manage their finances. These methods include incremental budgeting and zero-based budgeting, each with its own advantages and disadvantages.

Incremental Budgeting

Incremental budgeting involves making minor adjustments to the previous period’s budget to account for changes in the upcoming period. This method is relatively simple and less time-consuming compared to other budgeting techniques. However, it can lead to budgetary slack, where managers intentionally overestimate expenses to ensure they meet their budget targets.

Zero-Based Budgeting

Zero-based budgeting requires organizations to justify every expense from scratch, regardless of previous budgets. This method promotes efficiency and cost-saving by forcing managers to reevaluate all expenses and prioritize based on current needs. However, zero-based budgeting can be time-consuming and may not be practical for large organizations with complex operations.

Over time, traditional budgeting methods have evolved to adapt to changing financial landscapes. Organizations are now incorporating technology to streamline budgeting processes and improve accuracy. Additionally, there is a shift towards more flexible budgeting approaches that allow for adjustments throughout the year based on performance and changing circumstances.

Advanced Budgeting Techniques

When it comes to advanced budgeting techniques, companies and individuals can take their financial planning to the next level by implementing strategies like activity-based budgeting and rolling budgets. These techniques offer a higher level of flexibility and accuracy in managing finances.

Activity-Based Budgeting

Activity-based budgeting is a method that focuses on linking budgeted costs to specific activities within an organization. By aligning resources with activities that drive value, companies can allocate funds more efficiently and effectively.

- Activity-based budgeting helps companies identify areas where costs can be reduced or reallocated based on the impact on overall performance.

- By understanding the cost drivers of each activity, organizations can make more informed decisions about resource allocation and budgeting.

- For example, a manufacturing company may use activity-based budgeting to allocate costs based on the production volume of each product line, leading to more accurate budget forecasts.

Rolling Budgets

Rolling budgets involve continuously updating budgets on a regular basis, typically monthly or quarterly, to reflect changes in business conditions and performance. This approach allows companies to adapt quickly to market fluctuations and adjust financial plans accordingly.

- Rolling budgets provide a dynamic view of financial performance, allowing companies to make timely decisions based on the most up-to-date information available.

- With rolling budgets, organizations can forecast future financial outcomes more accurately by incorporating real-time data and adjusting projections as needed.

- For instance, a tech startup may use rolling budgets to monitor cash flow and adjust spending priorities based on changing market trends and customer demands.

Technology in Budgeting

Technology has completely transformed the way we approach budgeting, providing us with powerful tools to streamline the process and make it more efficient. With the rise of budgeting software and apps, individuals and businesses now have access to a wide range of features that can help them better manage their finances.

Benefits of Using Technology in Budgeting

- Automation: Budgeting tools can automate tasks like expense tracking, bill payments, and savings contributions, saving time and reducing the risk of human error.

- Real-time tracking: With technology, you can monitor your financial transactions in real-time, enabling you to make immediate adjustments to your budget as needed.

- Data analysis: Budgeting software can analyze your spending patterns and provide insights into where your money is going, helping you make more informed financial decisions.

Tips for Selecting the Right Budgeting Technology

- Consider your needs: Identify the specific features you require, such as goal setting, debt tracking, or investment management, and choose a tool that aligns with your priorities.

- Ease of use: Look for budgeting software or apps that are user-friendly and intuitive, making it easier for you to navigate and utilize all the features effectively.

- Compatibility: Ensure that the budgeting technology you select is compatible with your devices and operating systems, allowing you to access your financial information seamlessly across all platforms.