Get ready to dive into the world of financial yield calculation, where numbers come alive and decisions are made. This topic isn’t just about math—it’s about unlocking the secrets to smart investing and financial success.

From understanding different types of yields to exploring the methods behind accurate calculations, this journey will equip you with the tools needed to navigate the complex world of finance.

Introduction to Financial Yield Calculation

Financial yield calculation refers to the process of determining the return on an investment over a specific period of time. It is a crucial metric used by investors to evaluate the profitability of their investments.

Understanding financial yield is important as it helps investors make informed decisions regarding where to allocate their funds. By calculating the yield, investors can compare different investment opportunities and choose the one that offers the highest potential return.

Examples of Common Uses of Financial Yield Calculation

- Bond Investments: When investors purchase bonds, they calculate the bond yield to assess the potential income they can earn from the investment.

- Real Estate: In real estate, investors use yield calculation to determine the annual return on investment properties, considering factors such as rental income and property appreciation.

- Stocks: Investors analyze the dividend yield of stocks to evaluate how much return they can expect to receive from holding a particular stock.

Types of Financial Yield

When it comes to financial yield calculations, there are several types that investors use to evaluate the returns on their investments. Let’s break down some of the key types of financial yield calculations and how they differ from each other.

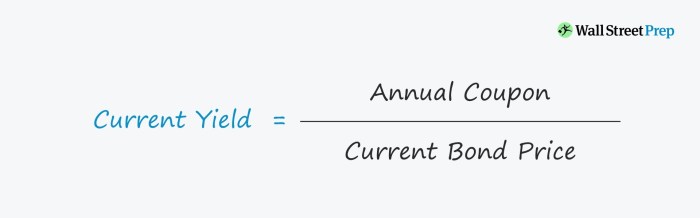

Current Yield

The current yield is a simple calculation that shows the annual return on an investment relative to its current market price. It is calculated by dividing the annual interest or dividend payment by the current market price of the investment. This type of yield is most useful for investors who are looking for quick insights into the potential returns of an investment without factoring in the time value of money.

Yield to Maturity

Yield to maturity (YTM) is a more complex calculation that takes into account the total returns an investor can expect to receive if they hold the investment until maturity. It considers not only the annual interest or dividend payments but also any capital gains or losses that may occur as the investment approaches maturity. YTM is most useful for investors who plan to hold an investment until maturity and want a more comprehensive view of their potential returns.

Dividend Yield

Dividend yield focuses specifically on the income generated by dividend-paying stocks. It is calculated by dividing the annual dividend payment by the current market price of the stock. Dividend yield is a key metric for income investors looking for regular cash flow from their investments. It is especially useful for those seeking to build a portfolio that provides a steady stream of income over time.

Factors Influencing Financial Yield Calculation

When calculating financial yield, there are several key factors that come into play. These factors can significantly impact the final yield amount and are crucial to consider in any investment decision. Let’s delve into some of the main influencers that affect financial yield calculations.

Interest Rates Impact

Interest rates play a major role in determining financial yield. When interest rates rise, the yield on investments typically increases as well. This is because higher interest rates mean higher returns on investments, leading to a higher overall yield. Conversely, when interest rates are low, the yield on investments tends to be lower. It is essential to keep a close eye on interest rate movements to accurately predict and calculate financial yield.

Market Conditions Influence

Market conditions can heavily influence financial yield calculations. Factors such as economic stability, inflation rates, and market volatility can impact the overall yield of an investment. For instance, during periods of economic uncertainty or high inflation, the yield on investments may decrease due to increased risks and lower returns. On the other hand, in more stable market conditions, the yield on investments may be higher. Understanding and analyzing market conditions is vital in accurately assessing financial yield.

Methods of Financial Yield Calculation

When it comes to calculating financial yield, there are several common methods that investors use to determine the return on their investments. These methods include simple yield and compound yield. Each method has its advantages and limitations, so it’s important to understand how to calculate financial yield using different approaches.

Simple Yield Calculation

To calculate simple yield, you can use the following formula:

Simple Yield = (Annual Interest or Dividend / Initial Investment) x 100

Here’s a step-by-step guide on how to calculate simple yield:

1. Determine the annual interest or dividend earned from the investment.

2. Divide the annual interest or dividend by the initial investment amount.

3. Multiply the result by 100 to get the simple yield percentage.

Compound Yield Calculation

Calculating compound yield involves taking into account the effect of compounding on the investment return. The formula for compound yield is more complex, but it provides a more accurate representation of the return on investment over time. Here’s how to calculate compound yield:

Compound Yield = [(1 + (Annual Interest or Dividend / Number of Compounding Periods)) ^ Number of Compounding Periods – 1] x 100

To calculate compound yield:

1. Determine the annual interest or dividend earned from the investment.

2. Divide the annual interest or dividend by the number of compounding periods.

3. Add 1 to the result.

4. Raise the sum to the power of the number of compounding periods.

5. Subtract 1 from the result and multiply by 100 to get the compound yield percentage.

Comparison of Calculation Methods

When comparing simple yield and compound yield calculations, it’s essential to consider their advantages and limitations. While simple yield is easier to calculate and provides a quick snapshot of the return on investment, compound yield takes compounding into account and offers a more accurate representation of the actual return over time.

- Simple yield is straightforward and easy to understand, making it suitable for quick calculations.

- Compound yield accounts for the effect of compounding, giving a more realistic view of the investment’s performance.

- However, compound yield calculations can be more complex and may require additional time and effort.

Overall, the choice between simple yield and compound yield calculation methods depends on the investor’s preference for simplicity or accuracy in assessing investment returns.

Importance of Accurate Financial Yield Calculation

Accurate financial yield calculation is crucial in the world of finance as it impacts decision-making processes and overall profitability. Inaccurate calculations can lead to misleading information and wrong financial decisions, which can have serious consequences for individuals and businesses alike.

Implications of Inaccurate Financial Yield Calculations

- Incorrect financial yield calculations can result in misjudging the performance of an investment, leading to potential losses.

- Inaccurate calculations may also affect budgeting and planning processes, causing financial instability and inefficiency.

- It can impact the credibility of financial reports and statements, leading to distrust from stakeholders and investors.

How Accurate Financial Yield Calculations Aid in Decision-making

- Accurate financial yield calculations provide reliable data for making informed investment decisions, reducing risks and maximizing returns.

- It helps in evaluating the performance of investments, identifying profitable opportunities, and optimizing portfolio management strategies.

- By ensuring accuracy in calculations, individuals and organizations can make sound financial decisions that align with their goals and objectives.

Real-life Examples of Impactful Financial Yield Calculation

- One notable example is the accurate calculation of the return on investment (ROI) for a new product launch, which helped a company allocate resources effectively and achieve significant profitability.

- Accurate financial yield calculations in real estate investments have enabled investors to make strategic decisions in buying, selling, or holding properties, leading to substantial gains.

- Financial institutions rely on precise yield calculations to determine interest rates on loans and investments, influencing borrowing costs and investment returns for clients.