Ready to dive into the world of calculating ROI? Buckle up as we break down the importance of ROI in business decision-making, the formula overview, step-by-step calculations, and how to interpret the results. Get ready to level up your financial game!

Importance of ROI Calculation

Calculating ROI is crucial in business decision-making as it helps assess the profitability and efficiency of investments. By determining the return on investment, companies can make informed choices about where to allocate resources and which projects to pursue.

Impact on Investment Choices

- Example 1: Company A is considering two different projects to invest in. By calculating the ROI for each option, they can compare the potential returns and risks associated with each project, ultimately choosing the one with the higher ROI.

- Example 2: An individual is deciding between investing in stocks or real estate. By analyzing the ROI of each investment type, they can determine which option is likely to provide a better return in the long run.

Benefits for Financial Planning

- Understanding ROI helps in setting realistic financial goals and creating a strategic roadmap for achieving them.

- It allows businesses to evaluate the performance of past investments and adjust future strategies accordingly.

- ROI calculation provides insights into the overall health of a company’s finances and helps in making data-driven decisions.

ROI Formula Overview

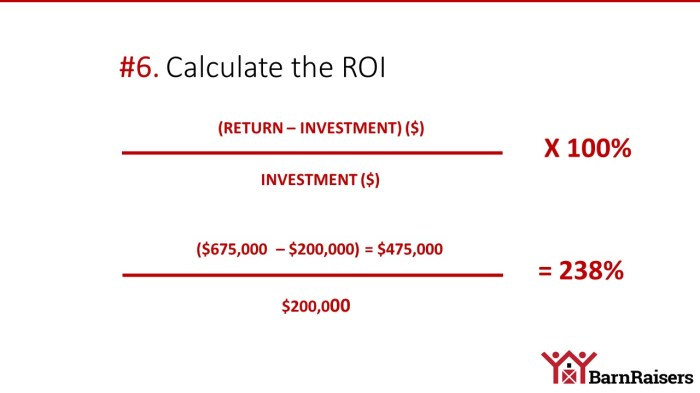

When it comes to calculating ROI, the formula is pretty straightforward. ROI, which stands for Return on Investment, is a financial metric used to evaluate the profitability of an investment. The formula for ROI is:

ROI = (Gain from Investment – Cost of Investment) / Cost of Investment

This formula takes into account two main components: the gain from the investment and the cost of the investment. The gain from the investment refers to the amount of money earned as a result of the investment, while the cost of the investment is the total amount of money spent on the investment.

Components of the ROI Formula

- The Gain from Investment is the total amount of money earned or realized from the investment. This can include revenues, sales, or any other financial benefits obtained.

- The Cost of Investment is the total amount of money spent on the investment, including initial costs, operating expenses, and any other associated costs.

Expressing ROI as a Percentage

- Once you have calculated the ROI using the formula, it is typically expressed as a percentage. This percentage represents the return on the investment relative to the cost of the investment.

- An ROI of 100% means that the gain from the investment is equal to the cost of the investment, resulting in breaking even. An ROI greater than 100% indicates a profit, while an ROI less than 100% indicates a loss.

Calculating ROI Step by Step

To calculate Return on Investment (ROI) effectively, you need to follow a structured approach that involves determining the gain from investment and calculating the cost of investment accurately.

Determining the Gain from Investment

- Start by identifying the total revenue generated from the investment. This includes all the income directly associated with the investment.

- Subtract the initial cost of the investment from the total revenue to get the net profit.

- Divide the net profit by the initial cost of the investment.

- Multiply the result by 100 to get the ROI percentage.

Calculating the Cost of Investment

- List down all the costs incurred during the investment period, including purchase price, maintenance costs, and any other expenses related to the investment.

- Sum up all the costs to get the total cost of investment.

Interpreting ROI Results

When it comes to interpreting ROI results, it’s important to understand what the numbers mean in terms of your investment performance. Whether you’re dealing with high or low ROI values, each scenario provides valuable insights that can help you make informed decisions about your investments.

High ROI Scenario

- A high ROI indicates that your investment has generated significant returns relative to its cost.

- This scenario is typically favorable, showing that your investment is performing well and yielding profitable outcomes.

- It suggests that you’re getting a good return on your investment, which is essential for growing your wealth and achieving financial goals.

Low ROI Scenario

- Conversely, a low ROI signifies that your investment has not generated substantial returns compared to its cost.

- This situation may indicate that your investment is underperforming or that the returns are not meeting your expectations.

- It could prompt you to reassess your investment strategy and consider making adjustments to improve future returns.

Analyzing and Comparing ROI Results

- When analyzing and comparing ROI results for different investments, it’s crucial to consider factors like the initial investment amount, time horizon, and risk involved.

- Comparing ROIs across multiple investment opportunities can help you prioritize where to allocate your resources for maximum returns.

- It’s essential to look at the big picture and assess the overall performance of your investments to make well-informed financial decisions.