Diving into the world of maximizing retirement savings, get ready to embark on a journey filled with financial wisdom and strategic planning. This guide will equip you with the knowledge and tools needed to secure a comfortable retirement future.

As we delve deeper, you’ll uncover valuable insights on setting achievable goals, exploring saving strategies, navigating retirement account options, leveraging employer benefits, and optimizing income sources. Let’s maximize those savings and secure a prosperous retirement ahead!

Understand Retirement Savings

Retirement savings are funds set aside for the future when an individual decides to stop working. These savings are crucial to ensure financial stability during retirement and maintain a comfortable lifestyle.

Types of Retirement Accounts

- 401(k): A retirement account offered by employers where employees can contribute a portion of their salary, often with employer matching contributions.

- IRA (Individual Retirement Account): A personal retirement account that allows individuals to save for retirement with tax advantages.

- Roth IRA: Similar to a traditional IRA, but contributions are made after taxes, allowing for tax-free withdrawals during retirement.

- 403(b): A retirement account typically offered to employees of educational institutions and non-profit organizations.

Setting Retirement Goals

Setting realistic retirement savings goals is crucial to ensure financial stability during your retirement years. Factors such as your current age, desired retirement age, life expectancy, expected expenses, and risk tolerance should all be considered when determining your retirement savings targets. By setting SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound), you can effectively plan and track your progress towards a financially secure retirement.

Factors to Consider When Determining Retirement Savings Targets

- Current Age: The earlier you start saving for retirement, the more time your money has to grow through compound interest.

- Desired Retirement Age: Determine the age at which you plan to retire and calculate the number of years you will need to fund your retirement.

- Life Expectancy: Consider how long you expect to live in retirement to ensure you have enough savings to last throughout your lifetime.

- Expected Expenses: Estimate your retirement expenses, including healthcare, housing, food, and leisure activities, to determine how much you will need to save.

- Risk Tolerance: Assess your comfort level with investment risk to determine the appropriate asset allocation for your retirement savings.

Examples of SMART Goals Related to Retirement Savings

- Specific: “I will save $500 per month in my retirement account to build a nest egg of $1 million by age 65.”

- Measurable: “I will increase my retirement savings contributions by 5% annually to reach a total of 15% of my income by the end of the year.”

- Achievable: “I will reduce my monthly expenses by $200 to free up additional funds for retirement savings.”

- Relevant: “I will review and adjust my retirement savings plan annually to ensure it aligns with my changing financial goals.”

- Time-bound: “I will max out my annual 401(k) contribution limit of $19,500 by December 31st to take advantage of tax benefits.”

Saving Strategies

Saving for retirement requires careful planning and strategic decision-making to ensure a comfortable future. There are various strategies you can implement to maximize your retirement savings, including investing in different asset classes, setting aside a certain percentage of your income, and taking advantage of employer-sponsored retirement plans.

Investing in Stocks vs. Bonds

When it comes to investing for retirement, you may consider allocating your funds into stocks or bonds. Stocks tend to offer higher returns over the long term but come with higher volatility and risk. On the other hand, bonds provide a more stable source of income with lower risk but offer lower potential returns. It’s essential to strike a balance between the two based on your risk tolerance, time horizon, and financial goals.

- Stocks:

- Higher potential returns

- Greater volatility and risk

- Long-term growth opportunities

- Bonds:

- Stable source of income

- Lower risk compared to stocks

- Less potential for high returns

It’s crucial to diversify your investment portfolio to mitigate risk and optimize returns over time.

Diversifying Retirement Savings

Diversification is key to reducing risk and maximizing returns when saving for retirement. By spreading your investments across different asset classes, such as stocks, bonds, real estate, and cash equivalents, you can protect your savings from market fluctuations and economic downturns. Diversification helps ensure that you have a well-rounded portfolio that can weather various market conditions and provide a more stable source of income during retirement.

- Benefits of Diversification:

- Minimize risk through asset allocation

- Potential for higher returns through a mix of investments

- Protection against market volatility

- Increased opportunities for growth and income

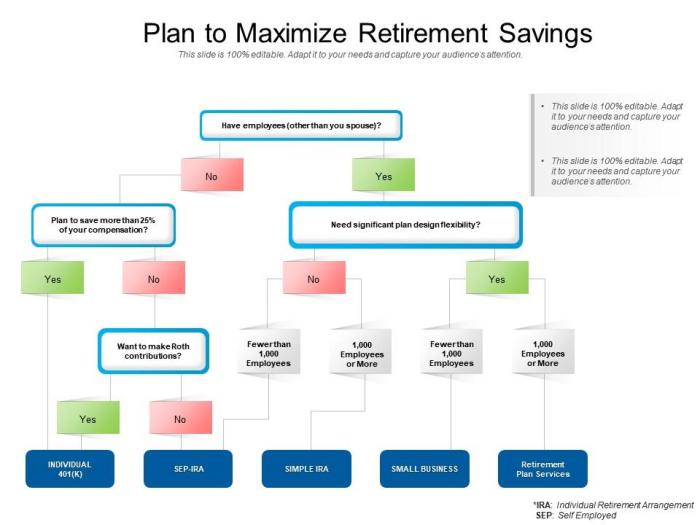

Retirement Account Options

When it comes to saving for retirement, there are several account options available to help you reach your financial goals. Understanding the differences between a 401(k), IRA, and Roth IRA can help you make the best choice based on your individual circumstances.

401(k)

- A 401(k) is an employer-sponsored retirement account where contributions are deducted directly from your paycheck before taxes.

- Contribution limits for 2021 are $19,500 for those under 50, with catch-up contributions of $6,500 for those 50 and older.

- Contributions are tax-deferred, meaning you don’t pay taxes on the money until you withdraw it during retirement.

IRA (Individual Retirement Account)

- An IRA is a retirement account that you open on your own, separate from your employer.

- Contribution limits for 2021 are $6,000 for those under 50, with catch-up contributions of $1,000 for those 50 and older.

- There are traditional IRAs, where contributions are tax-deductible, and Roth IRAs, where contributions are made with after-tax dollars.

Roth IRA

- A Roth IRA is similar to a traditional IRA, but contributions are made with after-tax dollars, meaning withdrawals in retirement are tax-free.

- Contribution limits for 2021 are the same as traditional IRAs, with income limits for eligibility.

- Roth IRAs offer more flexibility and tax advantages for those who expect to be in a higher tax bracket in retirement.

Choosing the Best Account

- Consider your current tax situation and future tax outlook when choosing between a traditional IRA and a Roth IRA.

- If your employer offers a 401(k) match, take advantage of it to maximize your retirement savings.

- Consult with a financial advisor to determine the best retirement account based on your individual goals and circumstances.

Employer Retirement Benefits

Employer-sponsored retirement plans play a crucial role in building a secure financial future for retirees. These plans often come with valuable benefits that can significantly boost your retirement savings.

Maximizing Employer Contributions

- One of the key strategies to maximize benefits from employer retirement plans is to contribute enough to take full advantage of any employer matching contributions. This is essentially free money that can help grow your retirement savings faster.

- Consider increasing your contribution rate over time to maximize employer matching. Even small increments can add up significantly over the long term.

- Regularly review your retirement plan and make adjustments as needed to ensure you are maximizing your employer contributions.

Additional Benefits of Employer Retirement Plans

- Employer retirement plans often offer tax advantages, such as tax-deferred growth on investments and potential tax deductions on contributions. Take advantage of these benefits to maximize your retirement savings.

- Some employer plans may provide additional perks, such as profit-sharing contributions or employer-funded pension plans. Be sure to understand and utilize all the benefits offered by your employer.

- Take advantage of financial education resources provided by your employer to make informed decisions about your retirement savings and investment options.

Social Security and Other Income Sources

When planning for retirement savings, it’s crucial to consider the role of Social Security benefits and other potential income sources. These can greatly impact your financial stability during retirement.

Social Security Benefits

- Social Security benefits are based on your earnings history and the age at which you begin receiving benefits.

- Delaying your Social Security benefits can increase the amount you receive each month, providing a higher income during retirement.

- It’s important to understand how your Social Security benefits will integrate with your overall retirement savings strategy.

Other Income Sources

- Pensions from current or previous employers can provide a reliable source of income during retirement.

- Annuities are another option to consider, offering guaranteed payments over a specific period of time.

- Income from rental properties, investments, or part-time work can also supplement your retirement savings.

Optimizing Social Security Benefits

- Consider your full retirement age when deciding when to start collecting Social Security benefits.

- Maximize your benefits by waiting until age 70, if possible, to start receiving payments.

- Review your earnings record to ensure accuracy and maximize your benefit amount.