Yo, diving into the world of reducing debt is crucial for anyone looking to secure their financial future. From credit card debts to student loans, the journey to financial freedom starts with understanding what debt is and how it can impact your money game. Stay tuned as we break down the steps to take control of your finances and say goodbye to debt for good.

Understanding Debt

Debt is money borrowed by an individual or entity that needs to be repaid with interest. There are different types of debt, including credit card debt, student loans, mortgages, and personal loans. Each type of debt comes with its own terms and conditions that affect repayment.

Being in debt can have serious consequences on one’s financial health. It can lead to high-interest payments, damage credit scores, limit future borrowing opportunities, and cause stress and anxiety. Understanding the impact of debt is crucial in taking steps to reduce and manage it effectively.

Assessing Your Debt Situation

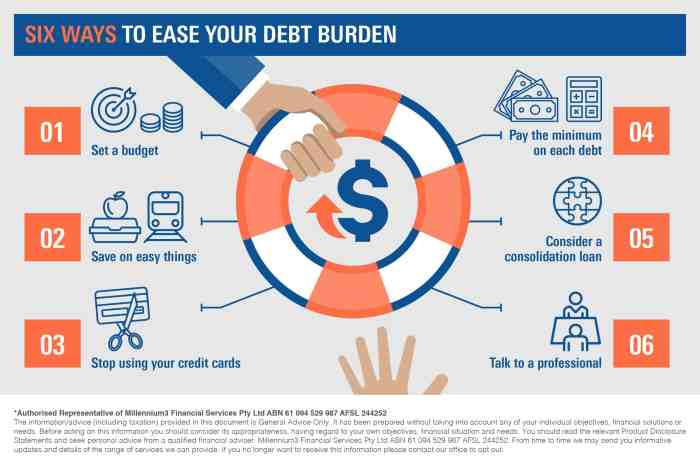

Before creating a plan to reduce debt, it’s essential to assess your current debt situation. This involves gathering information about all outstanding debts, including the amount owed, interest rates, minimum payments, and due dates. By having a clear picture of your debt obligations, you can prioritize which debts to tackle first and develop a strategy to pay them off efficiently.

Creating a Budget

Creating a budget is a crucial step in managing debt effectively. By tracking your income, expenses, and debt payments, you can gain a clear understanding of your financial situation and make informed decisions to reduce debt. Setting financial goals within your budget helps prioritize debt repayment and ensures you stay on track towards financial stability.

Steps to Create a Budget

- List all sources of income, including salary, bonuses, and any other additional income.

- Track all expenses, such as bills, groceries, transportation, and entertainment.

- Determine your debt payments, including credit card debt, loans, and any other outstanding debts.

- Calculate your total income and subtract your expenses and debt payments to see how much you have left for savings or additional debt repayment.

Significance of Budgeting in Managing Debt

Creating a budget allows you to see where your money is going and identify areas where you can cut back to allocate more funds towards debt repayment. It helps you avoid overspending, stay organized, and track your progress towards financial goals.

Tips for Setting Financial Goals within a Budget

- Set specific and achievable financial goals, such as paying off a certain amount of debt by a certain deadline.

- Prioritize high-interest debt to save money on interest payments in the long run.

- Track your progress regularly and make adjustments to your budget as needed to reach your financial goals faster.

- Celebrate small victories along the way to stay motivated and committed to your debt repayment journey.

Developing a Debt Repayment Strategy

When it comes to tackling your debt, having a solid repayment strategy in place is crucial. By comparing different methods and exploring ways to negotiate with creditors, you can work towards becoming debt-free faster.

Snowball Method vs. Avalanche Method

- The snowball method involves paying off your smallest debt first, then moving on to the next smallest, regardless of interest rates. This can provide a psychological boost as you see debts being eliminated.

- The avalanche method, on the other hand, focuses on paying off debts with the highest interest rates first. This can save you money in the long run by reducing the amount of interest you pay.

Negotiating with Creditors or Debt Consolidation

- When negotiating with creditors, be honest about your financial situation and explore options for reduced interest rates or payment plans.

- Debt consolidation involves combining multiple debts into one lower-interest loan, making it easier to manage payments and potentially save money on interest.

Increasing Income or Cutting Expenses

- Consider taking on a part-time job or freelance work to increase your income and allocate more funds towards debt repayment.

- Look for ways to cut expenses, such as reducing dining out, canceling subscription services, or finding more affordable alternatives for everyday items.

Seeking Professional Help

When it comes to reducing debt, there may be times when seeking help from credit counseling services or financial advisors becomes necessary. These professionals can provide expert guidance and support to help you navigate your way out of debt more effectively.

Debt Management Plans and Debt Consolidation Programs

- Debt management plans involve working with a credit counseling agency to negotiate lower interest rates and monthly payments with your creditors. These plans help you consolidate your debts into one manageable monthly payment.

- Debt consolidation programs, on the other hand, involve taking out a new loan to pay off multiple existing debts. This can simplify your debt repayment process and potentially lower your overall interest rates.

Identifying Reputable Professionals or Organizations

- Look for professionals or organizations that are accredited and certified in credit counseling or financial planning.

- Check reviews and testimonials from previous clients to gauge the reputation and effectiveness of the service provider.

- Avoid companies that promise quick fixes or charge high upfront fees before providing any services.

- Ask for a clear breakdown of all fees and services offered before committing to any debt management plan or consolidation program.