Diving deep into the realm of index fund advantages, this intro sets the stage for an exciting journey through the world of finance. Get ready to explore the benefits and perks of investing in index funds like never before.

As we delve further into the details, you’ll uncover the secrets behind why index funds are a popular choice for many investors looking to grow their wealth steadily and efficiently.

Overview of Index Funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index, such as the S&P 500. Unlike actively managed funds, which involve fund managers making investment decisions to outperform the market, index funds follow a passive investing strategy.

Passive investing in index funds involves simply tracking the performance of a particular index, rather than trying to beat the market through frequent buying and selling of securities. This results in lower management fees and typically better long-term returns compared to actively managed funds.

Popular Index Funds

- Vanguard Total Stock Market Index Fund (VTSAX)

- Schwab S&P 500 Index Fund (SWPPX)

- iShares Core S&P 500 ETF (IVV)

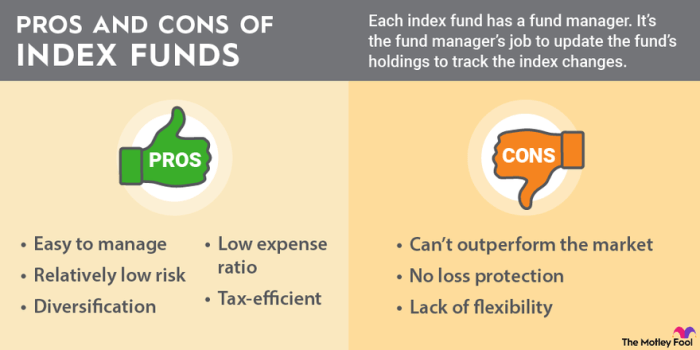

Advantages of Investing in Index Funds

Index funds offer several advantages that make them an attractive option for investors looking to build a diversified portfolio while keeping costs low.

Index funds typically have lower fees compared to actively managed funds, which can have a significant impact on returns over the long term. By minimizing expenses, investors can retain more of their investment gains and potentially achieve higher returns.

One of the key benefits of index funds is the built-in diversification they offer. Instead of trying to pick individual stocks or bonds, index funds invest in a wide range of securities that mirror a specific market index. This diversification helps reduce risk by spreading investments across different asset classes and industries.

When comparing the performance of index funds to actively managed funds over the long term, research has shown that index funds tend to outperform the majority of actively managed funds. This is primarily due to lower costs and the passive nature of index fund investing, which eliminates the need for frequent trading and active management fees.

Lower Fees and Impact on Returns

Index funds typically have lower fees compared to actively managed funds, which can have a significant impact on returns over the long term. Lower fees mean more of the investment gains are retained by investors, leading to potentially higher returns.

Benefits of Diversification

Index funds provide built-in diversification by investing in a wide range of securities that mirror a specific market index. This diversification helps reduce risk by spreading investments across different asset classes and industries, ultimately offering a more stable investment option for investors.

Performance Comparison with Actively Managed Funds

Research has consistently shown that index funds tend to outperform the majority of actively managed funds over the long term. This is attributed to lower costs, minimal trading, and the passive nature of index fund investing, which collectively contribute to better performance outcomes for investors.

Accessibility and Simplicity

Investing in index funds is not only accessible but also straightforward, making it a popular choice for a wide range of investors. Let’s dive into how index funds provide accessibility and simplicity in the investment world.

Accessible to a Wide Range of Investors

Index funds are designed to track a specific market index, such as the S&P 500, making them a great option for investors who want diversified exposure to a broad market. This accessibility allows individual investors, institutional investors, and even beginners to participate in the stock market without needing to pick individual stocks.

Simplicity of Investing in Index Funds

Compared to selecting individual stocks, investing in index funds is much simpler. Instead of researching and analyzing multiple companies, investors can simply buy shares of an index fund that mirrors the performance of a particular index. This hands-off approach eliminates the need for constant monitoring and decision-making, making it a low-maintenance investment option.

Platforms and Tools for Easy Investing

Several online platforms and tools have made investing in index funds incredibly easy for beginners. Robo-advisors, such as Betterment and Wealthfront, offer automated investment services that help investors build a diversified portfolio of index funds based on their risk tolerance and financial goals. Additionally, brokerage firms like Vanguard, Fidelity, and Charles Schwab provide user-friendly interfaces for purchasing and managing index fund investments. These platforms offer educational resources, portfolio management tools, and customer support to simplify the investing process for all levels of investors.

Tax Efficiency of Index Funds

When it comes to taxes, index funds are like the superheroes of the investment world. They are known for their tax efficiency compared to other investment options, which can make a big difference in your overall returns.

Capital Gains Distributions

Capital gains distributions are like the dividends you receive from your investments.

In the case of index funds, these distributions are usually lower compared to actively managed funds. This means you’ll have less taxable income to report, leading to potential tax savings in the long run.

Tax Advantages for Investors

- Index funds typically have lower turnover rates, which means fewer transactions and lower capital gains taxes for investors.

- Since index funds aim to replicate a specific market index, they often buy and hold securities for the long term, reducing the impact of short-term capital gains.

- Investors can also benefit from tax-deferred growth within index funds, especially in retirement accounts like 401(k)s or IRAs.