When it comes to investing, understanding the differences between mutual funds and ETFs is crucial. Get ready to dive into the world of finance as we explore the ins and outs of these two popular investment options.

From investment strategies to cost breakdowns, we’ll cover it all in a way that’s easy to grasp and even easier to apply to your own financial journey.

Overview of Mutual Funds and ETFs

Mutual funds and ETFs are both popular investment vehicles that allow individuals to pool their money together to invest in a diversified portfolio of assets. While they share some similarities, there are key differences between the two.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They are actively managed by professional fund managers who make investment decisions on behalf of the investors. Mutual funds are priced once a day at the end of the trading day.

ETFs

Exchange-traded funds (ETFs) are similar to mutual funds in that they also pool money from multiple investors to invest in a diversified portfolio of assets. However, ETFs are traded on stock exchanges throughout the day, like individual stocks. They are passively managed and typically track a specific index or sector.

Key Differences

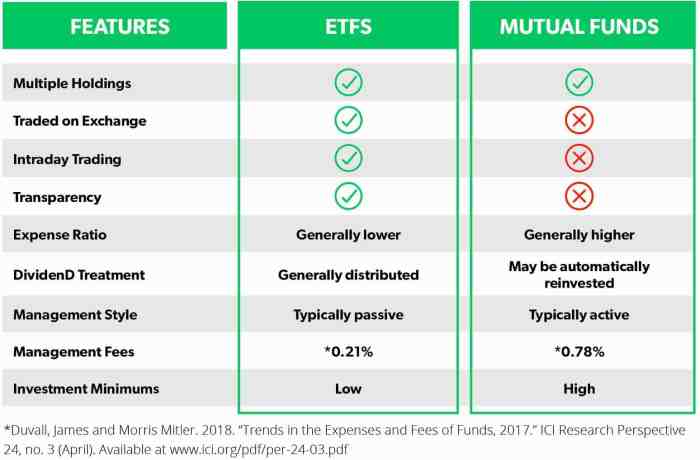

- Mutual funds are actively managed by professional fund managers, while ETFs are passively managed and typically track an index.

- Mutual funds are priced once a day at the end of the trading day, while ETFs are traded on exchanges throughout the day.

- ETFs tend to have lower expense ratios compared to mutual funds.

- Mutual funds may have minimum investment requirements, while ETFs can be purchased in single shares.

Investment Strategies

When it comes to investment strategies, mutual funds and ETFs each have their own unique approach to investing in the market. Let’s take a closer look at the common strategies used for mutual funds and how ETFs are typically utilized within investment strategies.

Common Investment Strategies for Mutual Funds

- Diversification: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. This helps reduce risk by spreading investments across different assets.

- Active Management: Many mutual funds are actively managed by professional fund managers who aim to outperform the market by selecting specific securities based on their research and analysis.

- Long-Term Investing: Mutual funds are often used for long-term investing goals, such as retirement planning, as they offer a hands-off approach for investors looking to grow their wealth over time.

Utilization of ETFs in Investment Strategies

- Passive Investing: ETFs are known for their passive management approach, tracking a specific index or asset class. This makes them a popular choice for investors looking to mirror the performance of the overall market.

- Trading Flexibility: ETFs can be bought and sold throughout the trading day at market prices, providing investors with the flexibility to react to market movements quickly.

- Tactical Asset Allocation: ETFs can be used strategically within a portfolio to allocate assets to different sectors or regions based on market conditions, allowing investors to adjust their exposure accordingly.

Comparison of Investment Approaches

- Mutual funds are actively managed, while ETFs typically follow a passive index-tracking approach.

- Mutual funds are priced once a day at the net asset value (NAV), while ETFs are traded on an exchange throughout the day at market prices.

- Mutual funds are better suited for long-term investors looking for professional management, while ETFs are favored by those seeking lower costs, trading flexibility, and transparency.

Cost Differences

When it comes to investing in mutual funds and ETFs, understanding the cost differences between these two options is crucial for investors. Let’s break down the fees associated with mutual funds and the cost structure of ETFs to see how they differ in terms of expenses.

Fees Associated with Mutual Funds

Mutual funds typically come with various fees that investors need to consider when investing. These fees can include:

- Management fees: These are fees charged by the fund manager for managing the fund’s investments.

- Expense ratio: This is an annual fee that covers the operating expenses of the fund and is expressed as a percentage of the fund’s assets.

- Load fees: Some mutual funds charge load fees, which are sales charges either when you buy (front-end load) or sell (back-end load) shares of the fund.

- Transaction fees: These are fees charged for buying or selling shares of the mutual fund.

Cost Structure of ETFs

ETFs generally have a different cost structure compared to mutual funds. Some of the expenses that investors may incur with ETFs include:

- Brokerage commissions: Investors trading ETFs on the stock exchange may have to pay brokerage commissions, similar to trading individual stocks.

- Expense ratio: Like mutual funds, ETFs also have expense ratios that cover the fund’s operating expenses.

- Spread costs: When buying or selling ETF shares, investors may incur spread costs, which refer to the difference between the bid and ask prices of the ETF.

Overall, ETFs tend to have lower expense ratios compared to mutual funds, making them a cost-effective option for many investors.

Liquidity and Trading

When it comes to investing in mutual funds and ETFs, understanding liquidity and trading is essential for investors to make informed decisions.

Liquidity of Mutual Funds

Mutual funds are known for their liquidity, as investors can buy or sell their shares at the end of the trading day at the fund’s net asset value (NAV). This means investors can easily access their money when needed, providing flexibility in managing their investments.

Trading Process for ETFs

ETFs are traded on stock exchanges throughout the trading day, allowing investors to buy and sell shares at market prices. This differs from mutual funds, which are only traded at the end of the day. The intraday trading feature of ETFs provides investors with the opportunity to react quickly to market changes and adjust their positions accordingly.

Advantages and Disadvantages of Liquidity

- Advantages:

- Flexibility for investors to access their funds when needed.

- Ability to react quickly to market changes with intraday trading for ETFs.

- Disadvantages:

- Potential for increased trading costs with intraday trading of ETFs.

- Market volatility can impact prices when trading ETFs throughout the day.

Tax Efficiency

When it comes to investing, tax efficiency plays a crucial role in determining overall returns. Let’s take a look at how tax implications differ between mutual funds and ETFs.

Tax Implications for Investors in Mutual Funds

Investors in mutual funds may face capital gains taxes due to the fund manager buying and selling securities within the fund. This can lead to taxable events for investors, even if they didn’t personally sell any shares.

Tax Efficiency of ETFs Compared to Mutual Funds

ETFs are known for their tax efficiency because of how they are structured. Unlike mutual funds, ETFs generally have lower portfolio turnover, which means fewer taxable events for investors.

Examples of Tax Advantages that ETFs May Offer to Investors

- ETFs allow investors to control when they realize capital gains, as they can choose when to buy or sell shares individually.

- ETFs may offer tax benefits through in-kind redemptions, where investors can redeem shares without triggering a taxable event.

- ETFs can also be more tax-efficient in terms of dividend distributions, potentially reducing tax burdens for investors.

Diversification

Diversification is a crucial aspect of investment strategy that helps reduce risk by spreading investments across different assets.

Mutual Funds Diversification

Mutual funds achieve diversification by pooling money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. This allows individual investors to access a broad range of assets without needing to purchase each one individually.

ETFs Diversification

ETFs also offer diversification by holding a basket of securities, similar to mutual funds. However, ETFs trade on exchanges like stocks, and investors can buy and sell them throughout the trading day. This differs from mutual funds, which are priced once a day after the market closes.

Comparison of Diversification

Both mutual funds and ETFs provide diversification benefits, but the level of diversification can vary. Mutual funds tend to be actively managed, with fund managers making decisions on which securities to buy and sell. On the other hand, ETFs often passively track an index, providing exposure to a specific market segment. This can result in differences in the number of holdings and the overall diversification level between mutual funds and ETFs.