Real Estate Investing Tips takes center stage in this guide, offering a fresh perspective on the world of real estate investments. With insights on crucial factors and strategies, this piece aims to equip readers with the knowledge needed to thrive in the real estate market.

Understanding Real Estate Investing: Real Estate Investing Tips

Real estate investing involves purchasing, owning, managing, renting, or selling real estate for the purpose of generating profit. It is a long-term investment strategy that can offer various benefits to investors.

Types of Real Estate Investments

- Residential Properties: Investing in single-family homes, condominiums, townhouses, or apartment buildings for rental income.

- Commercial Properties: Owning office buildings, retail spaces, hotels, or industrial properties for leasing to businesses.

- Real Estate Investment Trusts (REITs): Investing in publicly traded companies that own, operate, or finance income-producing real estate.

- Fix and Flip Properties: Purchasing distressed properties, renovating them, and selling them for a profit.

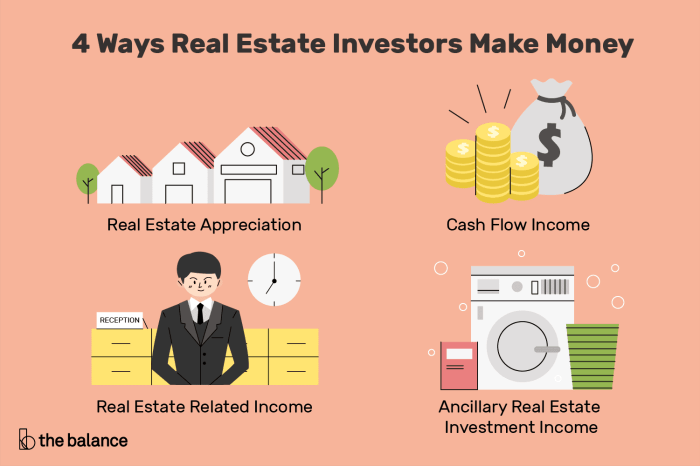

Benefits of Real Estate Investing

- Appreciation: Real estate values tend to increase over time, providing potential for long-term capital gains.

- Income Generation: Rental properties can generate regular income through monthly rent payments.

- Tax Advantages: Investors can benefit from tax deductions, depreciation, and other tax incentives related to real estate investments.

- Diversification: Real estate can help diversify an investment portfolio, reducing risk through exposure to different asset classes.

Essential Factors to Consider

When it comes to real estate investing, there are several key factors that you need to consider before making any decisions. From location to market analysis, each factor plays a crucial role in determining the success of your investment.

Location Matters, Real Estate Investing Tips

Location is one of the most important factors to consider when investing in real estate. A property’s location can greatly impact its value, rental income potential, and overall desirability. Whether you’re looking to buy a property for rental income or resale, choosing the right location can make a significant difference in your returns. Factors such as proximity to schools, shopping centers, public transportation, and job opportunities can all influence the value of a property.

Importance of Market Analysis

Market analysis is another essential factor to consider before investing in real estate. Conducting thorough research on the local real estate market will help you make informed decisions about which properties to invest in. Understanding market trends, property values, rental rates, and vacancy rates can help you identify profitable investment opportunities. By analyzing the market, you can also determine the best time to buy or sell a property, maximizing your returns and minimizing risks.

Financing Options

When it comes to real estate investments, having the right financing options is crucial for success. Let’s explore different ways to finance your real estate ventures.

Traditional Bank Loans vs. Private Money Lenders

- Traditional Bank Loans:

- Lower interest rates compared to private lenders.

- Might require a higher credit score and more documentation.

- Longer approval process but can offer more stability.

- Private Money Lenders:

- Quick approval process with less stringent requirements.

- Higher interest rates and fees than traditional bank loans.

- Flexibility in terms and conditions of the loan.

Remember to carefully weigh the pros and cons of each financing option to choose the best fit for your real estate investment strategy.

Leveraging in Real Estate Investments

- Leveraging involves using borrowed capital to increase the potential return on investment.

- Allows investors to control a larger asset with a smaller initial investment.

- However, leveraging also increases risk as any losses will be magnified.

Property Management Tips

Effective property management is crucial for real estate investors to maximize their returns and ensure the longevity of their rental properties. Regular maintenance and the use of property managers can significantly impact the success of your real estate investments.

The Importance of Regular Property Maintenance

- Regular maintenance helps prevent costly repairs by addressing small issues before they escalate.

- It enhances the value of your property and attracts high-quality tenants who are willing to pay top dollar for a well-maintained home.

- Regular maintenance also ensures compliance with local housing regulations, avoiding potential fines or legal issues.

The Role of Property Managers

Property managers play a crucial role in overseeing day-to-day operations, handling tenant issues, and ensuring the property is well-maintained.

- They can help find and screen tenants, collect rent, and handle maintenance requests promptly.

- Property managers also act as a buffer between landlords and tenants, handling any disputes or issues that may arise.

- By delegating these responsibilities to a property manager, real estate investors can free up their time and focus on growing their investment portfolio.

Risk Management Strategies

Real estate investing can be lucrative, but it also comes with its fair share of risks. To mitigate these risks, real estate investors should implement effective risk management strategies. By doing so, they can protect their investments and increase their chances of success.

Diversification in Real Estate Investment Portfolios

Diversification is a key risk management strategy in real estate investing. By diversifying their investment portfolios, investors can spread their risk across different properties and markets. This helps to minimize the impact of any potential losses on a single property or market. Additionally, diversification can also provide opportunities for higher returns by tapping into various real estate sectors and regions.

- Investing in different types of properties such as residential, commercial, and industrial

- Exploring investments in different geographical locations to reduce market-specific risks

- Considering real estate investment trusts (REITs) as a way to diversify without directly owning properties

- Utilizing different financing options to minimize financial risk