As tax-deferred accounts take center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original. Get ready to dive into the realm of tax-deferral in financial planning like never before.

In this guide, we’ll explore everything from the basics of tax-deferred accounts to the intricate details of contribution limits, tax implications, investment options, and more. By the end, you’ll be equipped with a solid understanding of how tax-deferred accounts can work to your advantage.

What are Tax-Deferred Accounts?

Tax-deferred accounts are investment vehicles that allow individuals to postpone paying taxes on their contributions and investment earnings until a later date, usually retirement. This means that the money invested grows tax-free until it is withdrawn, providing an opportunity for greater wealth accumulation over time.

Concept of Tax Deferral in Financial Planning

Tax deferral in financial planning refers to the strategy of delaying the payment of taxes on income, gains, or dividends earned from investments. By utilizing tax-deferred accounts, individuals can maximize their savings potential and potentially lower their current tax burden while planning for future financial goals.

Examples of Tax-Deferred Accounts

- Traditional IRA: Contributions to a Traditional IRA are tax-deductible, and investment earnings grow tax-deferred until withdrawal.

- 401(k) Retirement Plan: Contributions to a 401(k) are made with pre-tax dollars, and both contributions and earnings are tax-deferred until retirement.

- Deferred Annuities: Annuities allow for tax-deferred growth on contributions, with taxes being paid upon withdrawal in retirement.

Types of Tax-Deferred Accounts

Tax-deferred accounts offer individuals the opportunity to save for retirement while deferring taxes on the contributions and earnings until withdrawals are made in the future.

1. 401(k)

- A 401(k) is an employer-sponsored retirement account where employees can contribute a portion of their salary before taxes.

- Employers may match a percentage of the employee’s contributions, providing a valuable incentive for saving.

- Contributions and earnings grow tax-deferred until withdrawal, typically during retirement.

- Withdrawals are taxed as ordinary income and may be subject to penalties if taken before the age of 59 ½.

2. Traditional IRA

- A traditional IRA is an individual retirement account that allows individuals to make tax-deductible contributions.

- Contributions and earnings within the IRA grow tax-deferred until withdrawal.

- Withdrawals are taxed as ordinary income, and early withdrawals may incur penalties.

- Individuals can contribute to a traditional IRA even if they have a 401(k) through their employer.

3. Annuities

- Annuities are insurance products that provide a guaranteed income stream during retirement.

- Contributions to annuities can grow tax-deferred until withdrawals are made.

- There are various types of annuities, including fixed, variable, and indexed annuities, each with different features and benefits.

- Withdrawals from annuities are typically taxed as ordinary income.

Contribution Limits and Rules

When it comes to tax-deferred accounts, understanding the contribution limits and rules is crucial for maximizing your savings while avoiding penalties. Let’s dive into the specifics below.

Contribution Limits

- For 2022, the annual contribution limit for a traditional IRA is $6,000 for individuals under 50 years old. Those 50 and older can make an additional catch-up contribution of $1,000, bringing their total limit to $7,000.

- For a 401(k) plan, the contribution limit for 2022 is $20,500 for individuals under 50 years old. Participants 50 and older can contribute an extra $6,500 as a catch-up contribution.

Eligibility Criteria

- To contribute to a traditional IRA, you must have earned income for the year. There are no age restrictions for contributing to a traditional IRA.

- For a 401(k) plan, eligibility is typically determined by your employer. Most employers allow employees to participate as soon as they start working, but some may have a waiting period.

Penalties for Exceeding Contribution Limits

- If you contribute more than the allowed limit to your tax-deferred account, you may face penalties from the IRS. For traditional IRAs, the penalty is 6% of the excess contribution each year until you correct the mistake.

- For 401(k) plans, the employer is responsible for monitoring contributions and ensuring they do not exceed the limits. If you go over the limit, you may need to withdraw the excess amount and pay taxes on it.

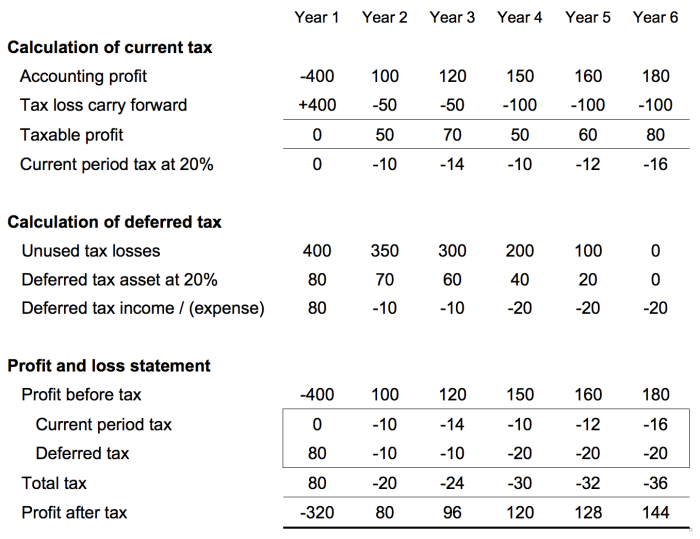

Tax Implications

When it comes to tax-deferred accounts, there are several key tax implications to consider. Let’s dive into how contributions, investing, and withdrawals affect your taxable income.

Contributions and Taxable Income

- Contributions made to tax-deferred accounts, such as Traditional IRAs or 401(k) plans, are typically tax-deductible in the year they are made.

- By contributing to these accounts, you can lower your taxable income for that year, potentially reducing the amount of taxes you owe.

- This tax benefit allows you to save more money for retirement while also getting a break on your current tax bill.

Tax Advantages of Investing

- One of the main tax advantages of investing in tax-deferred accounts is that your investments can grow tax-free until you make withdrawals.

- This means you won’t have to pay taxes on any capital gains, dividends, or interest earned within the account each year.

- As a result, your investments have the potential to grow faster over time compared to taxable accounts where you would owe taxes annually on investment gains.

Taxation of Withdrawals

- When you start making withdrawals from your tax-deferred accounts in retirement, the money you take out is subject to income tax.

- These withdrawals are treated as ordinary income, so you’ll need to pay taxes based on your tax bracket at the time of withdrawal.

- It’s important to plan for these taxes in retirement and consider strategies to minimize the tax impact of withdrawals, such as spreading out distributions over time.

Investment Options

When it comes to tax-deferred accounts, the investment options play a crucial role in maximizing returns and growing your wealth over time. By carefully selecting the right investment vehicles, you can make the most of your tax-advantaged savings.

Diversified Portfolio

Building a diversified portfolio is essential for long-term growth within tax-deferred accounts. By spreading your investments across different asset classes such as stocks, bonds, and real estate, you can reduce risk and increase the potential for higher returns. Remember, diversification is key to weathering market fluctuations and achieving financial goals over time.

Mutual Funds

Mutual funds are a popular investment choice within tax-deferred accounts due to their professional management and diversification benefits. These funds pool money from multiple investors to invest in a variety of securities, providing instant diversification and access to a range of asset classes. With options like index funds, actively managed funds, and target-date funds, investors have a broad selection to choose from based on their risk tolerance and investment goals.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade on exchanges like individual stocks. They offer diversification, low expenses, and flexibility in trading throughout the day. ETFs track various indexes, sectors, or commodities, allowing investors to gain exposure to specific areas of the market. With the ability to buy and sell ETFs at market prices, investors can easily adjust their portfolios and capitalize on market trends efficiently.

Individual Stocks and Bonds

For more experienced investors, individual stocks and bonds can be part of a tax-deferred account’s investment mix. Investing in individual companies’ stocks or government/corporate bonds can provide the opportunity for higher returns but also come with higher risk. It’s essential to research and analyze these investments thoroughly to ensure they align with your overall financial objectives and risk tolerance.

Rollovers and Transfers

When it comes to managing your tax-deferred accounts, understanding how rollovers and transfers work is crucial for optimizing your financial strategy. Rollovers involve moving funds from one tax-deferred account to another, while transfers involve shifting funds between similar types of accounts.

Rollovers

Rollovers are typically used when you want to move funds from one retirement account to another without incurring taxes or penalties. This can be done when changing jobs, consolidating accounts, or seeking better investment options. The process usually involves requesting a direct transfer of funds from one financial institution to another to ensure a smooth transition.

- Ensure the funds are directly transferred to avoid tax implications.

- Follow the specific guidelines of each account type to avoid penalties.

- Consider consulting a financial advisor for guidance on rollover procedures.

Transfers

Transfers are similar to rollovers but involve moving funds within the same type of tax-deferred account, such as transferring money from one Traditional IRA to another Traditional IRA. This can be done to take advantage of better investment options, lower fees, or improved customer service.

- Check with the financial institutions involved to understand their transfer process.

- Ensure you meet the eligibility requirements for transferring funds between accounts.

- Consider the timing of the transfer to minimize any potential market impact on your investments.

Benefits of Rollovers and Transfers

Both rollovers and transfers offer benefits depending on your financial goals and circumstances. Rollovers allow you to consolidate accounts, access better investment options, and avoid immediate tax consequences. On the other hand, transfers can help you optimize your investment strategy within the same account type and take advantage of different financial institution offerings.

By understanding the rules and considerations for rollovers and transfers, you can make informed decisions to maximize the growth potential of your tax-deferred accounts.