Diving into the world of Understanding economic cycles, get ready to explore the ins and outs of how the economy ebbs and flows. From the highs to the lows, we’ll break down the different phases and factors that drive these cycles.

Buckle up as we take a ride through the world of economic cycles, where trends and indicators shape the way we understand the economy.

What are economic cycles?

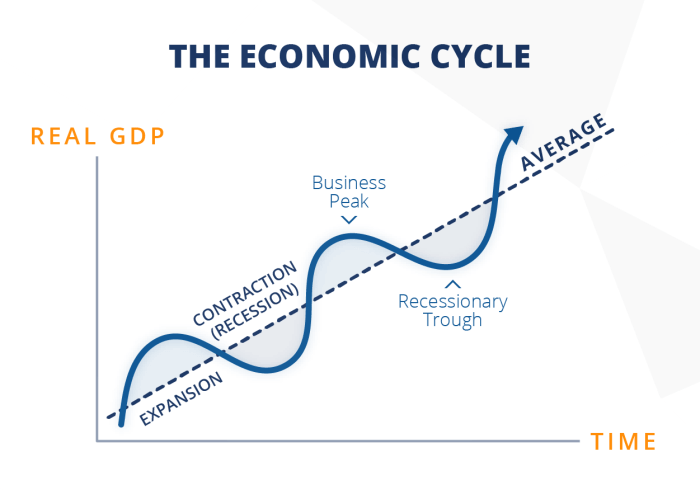

Economic cycles refer to the recurring patterns of expansion and contraction in economic activity over time. These cycles are characterized by periods of growth, peak, contraction, and trough.

Different phases of an economic cycle

- The Expansion Phase: This phase is marked by economic growth, increased production, rising employment levels, and consumer spending.

- The Peak Phase: At this stage, the economy reaches its highest level of activity, with low unemployment rates and high consumer confidence.

- The Contraction Phase: During this phase, economic growth slows down, leading to a decrease in production, rising unemployment, and reduced consumer spending.

- The Trough Phase: This is the lowest point of the cycle, characterized by high unemployment rates, low consumer confidence, and decreased economic activity.

Factors influencing economic cycles

- Monetary Policy: Central banks’ decisions on interest rates and money supply can impact economic cycles.

- Fiscal Policy: Government spending and taxation policies play a crucial role in influencing economic cycles.

- External Shocks: Events like natural disasters, political instability, or global economic changes can disrupt the normal cycle of economic activity.

- Consumer Confidence: The perception and behavior of consumers regarding the economy can influence the direction of economic cycles.

Types of economic cycles

Economic cycles can be categorized into different types based on their duration and impact on the economy. Let’s explore the various types of economic cycles and how they affect different sectors.

Short-term Economic Cycles

Short-term economic cycles, also known as business cycles, typically last for a few months to a couple of years. These cycles are characterized by fluctuations in economic activity, such as changes in production, employment, and consumer spending. Factors like changes in interest rates, government policies, and consumer confidence can influence short-term economic cycles. During an expansion phase, the economy grows, leading to increased employment and higher consumer spending. Conversely, during a contraction phase, the economy slows down, resulting in decreased production and rising unemployment.

Long-term Economic Cycles

Long-term economic cycles, also known as structural cycles, extend over several years to decades. These cycles are influenced by structural changes in the economy, such as technological advancements, demographic shifts, and geopolitical events. Long-term economic cycles can include periods of sustained economic growth, known as secular expansions, as well as periods of economic downturns, referred to as secular contractions. These cycles shape the overall trajectory of the economy and can have lasting effects on businesses and consumers.

Impact on Different Sectors

Different sectors of the economy are affected differently by economic cycles. For example, the housing sector tends to be sensitive to economic cycles, with real estate prices rising during economic expansions and falling during contractions. The manufacturing sector is also heavily influenced by economic cycles, as demand for goods fluctuates based on the overall economic conditions. Conversely, sectors like healthcare and utilities are generally considered more stable and less affected by economic cycles due to the essential nature of their services.

Indicators of economic cycles

Understanding economic cycles involves analyzing various indicators that help predict the direction of the economy. These indicators can be classified into three main categories: leading, lagging, and coincident indicators.

Leading Indicators

Leading indicators are signals that change before the economy as a whole changes. They are used to predict the future direction of the economy. Examples of leading indicators include:

- Stock market performance

- Building permits

- Consumer confidence index

Lagging Indicators

Lagging indicators, on the other hand, change after the economy has already started following a particular trend. They confirm long-term trends and are used to validate the current direction of the economy. Examples of lagging indicators include:

- Unemployment rate

- Corporate profits

- Interest rates

Co-incident Indicators

Co-incident indicators move in line with the economy, reflecting its current state. They provide real-time information about the economy’s performance. Examples of co-incident indicators include:

- Gross Domestic Product (GDP)

- Retail sales

- Industrial production

These indicators are crucial in predicting economic trends as they offer insights into the current and future state of the economy. By analyzing a combination of leading, lagging, and coincident indicators, economists and policymakers can make informed decisions to mitigate the impact of economic cycles.

Effects of economic cycles

Economic cycles have a significant impact on various aspects of the economy, including employment rates, inflation, and business strategies. Let’s delve deeper into how these cycles affect different areas of the economy.

Impact on Employment Rates

During an economic downturn or recession, businesses often cut back on hiring or even lay off workers to reduce costs. This leads to higher unemployment rates as job opportunities become scarce. Conversely, during an economic boom or expansion phase, businesses tend to ramp up hiring to meet increased demand, leading to lower unemployment rates.

Relationship with Inflation

Economic cycles also influence inflation rates. In times of economic growth, increased demand for goods and services can lead to rising prices, known as inflation. On the other hand, during economic downturns, lower demand can result in deflation or stagnant prices. Central banks often use monetary policy tools to control inflation rates during different phases of the economic cycle.

Adaptation of Business Strategies

Businesses adapt their strategies based on the phase of the economic cycle. During times of recession, companies may focus on cost-cutting measures, streamlining operations, and diversifying products/services to weather the economic storm. In contrast, during periods of expansion, businesses may invest in expansion, marketing, and innovation to capitalize on growing consumer demand and market opportunities.

Government intervention during economic cycles

Government policies play a crucial role in managing economic cycles by implementing fiscal and monetary measures to stabilize the economy. Let’s delve deeper into the effectiveness of these policies and explore historical examples of government interventions during economic downturns.

Role of Fiscal Policies

Fiscal policies involve government decisions on taxes and spending to influence the economy. During economic downturns, governments may increase spending on infrastructure projects or provide tax cuts to stimulate demand and boost economic activity.

Role of Monetary Policies

Monetary policies are controlled by central banks and involve decisions on interest rates and money supply. Lowering interest rates can encourage borrowing and spending, while increasing money supply can inject liquidity into the economy during downturns.

Effectiveness of Government Interventions

The effectiveness of fiscal and monetary policies in stabilizing the economy depends on the timing and magnitude of these interventions. For example, during the Great Depression in the 1930s, President Franklin D. Roosevelt’s New Deal programs aimed at boosting employment and infrastructure investment helped lift the economy out of the crisis.

Historical Examples of Government Interventions

– The 2008 financial crisis saw governments around the world implementing stimulus packages to prevent a complete economic collapse. The Troubled Asset Relief Program (TARP) in the U.S. was a massive government intervention to stabilize financial markets and restore confidence.

– During the COVID-19 pandemic, governments rolled out unprecedented fiscal measures such as direct payments to individuals and businesses, as well as monetary policies like quantitative easing to support liquidity and prevent a deep recession.

International implications of economic cycles

Economic cycles in one country can have significant impacts on global markets due to the interconnectedness of economies across the world. The transmission of economic cycles across borders is influenced by trade policies, financial flows, and supply chain dependencies.

Impact on Global Markets

- Economic downturns in major economies can lead to a decrease in demand for goods and services globally, affecting export-oriented countries.

- Financial crises in one country can trigger a domino effect on international markets, leading to volatility in stock prices and exchange rates.

- Changes in interest rates or monetary policies in one country can have ripple effects on global investments and capital flows.

Interconnectedness of Economies

- Globalization has deepened the integration of economies, making them more susceptible to economic shocks from other countries.

- Supply chains are spread across multiple countries, so disruptions in one country can impact production and distribution worldwide.

- Financial institutions operate globally, leading to interconnected banking systems that can amplify the transmission of economic cycles.

Trade Policies and Economic Cycles

- Trade barriers or tariffs imposed by one country can lead to retaliatory measures from trading partners, escalating economic tensions and affecting global trade volumes.

- Free trade agreements can help mitigate the negative effects of economic cycles by promoting stable trade relations and reducing uncertainties for businesses.

- International organizations like the World Trade Organization play a role in resolving trade disputes and maintaining a rules-based trading system during economic downturns.